Let’s face it, when it comes to wealth creation ‘saving’ is about the most boring method I can possibly think of, but trust me on this…. saving is the bedrock of wealth creation, and if you harness this simple little skill it has the power to change your life.

But before I get into my Top 5 Reasons to Save, let’s take a moment to define what I mean by ‘saving’. Saving, contrary to popular belief is not piling your money up in the bank earning 0.5% – Your road to wealth will be a very tough slog with a hell of a lot of sacrificed lifestyle if this is the path you choose.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” — Robert G. Allen

And perhaps this is the reason that people don’t do it? – A mistaken belief that ‘saving’ means taking your hard-earned after-tax dollars and putting them in a bank account earning peanuts. A presumption that ‘saving’ means joining the F.I.R.E movement and sacrificing the best years of your life in order to retire early (albeit in a continuation of the extreme frugality that allowed you to get there in the first place).

Well, let me clear that up right now. Saving isn’t about where you put your money – it’s about having money to put somewhere.

Saving is the habit of ensuring there is a gap between your income and expenses so that you can devote that money to achieving your wealth goals.

Despite the fact that this habit is easy to form and doesn’t cost much, we humans seem to prefer to seek out more exotic ways to increase our net worth. We somehow convince ourselves that more complexity, more risk, more ‘action’, and greater uncertainty = better (hint…it doesn’t). After all, something as simple as saving couldn’t possibly be the key to wealth creation could it?

Well, I have to tell you that boring can be beautiful and that if my Top 5 Reasons to Save can convince you to get started, the simple habit of ‘saving’ can set you on the path to financial freedom.

So without further ado, let’s look at my Top 5 reasons to Save.

#1: A Dollar Earned ≠ A Dollar Saved

The Beatles knew this all too well, and wrote a hit song about it which was the opening track on their 1966 album ‘Revolver’.

“If you drive a car, I’ll tax the street. If you try to sit, I’ll tax your seat. If you get too cold, I’ll tax the heat, If you take a walk, I’ll tax your feet, ‘Cause I’m the taxman, yeah, I’m the taxman”

Courtesy of the Tax Man, you only get to keep a portion of every dollar you earn above $18,200. This might only leave $0.70 with which to pay for life’s expenses and to devote to your wealth planning. Let’s look at a practical example…

Let’s say you need $10,000 every year to devote to your Wealth Plan (which allows you to pay off your house, have a $6K family holiday every year, put your kids through uni, fund their weddings, and help your retire at age 60 on $70,000 p/a). You have 2 choices about where to find this $10,000…. earn more, or spend less. Earning more requires you to earn significantly more than $10,000 due to the impact of tax, whereas lowering your expenses means every dollar saved = a dollar to devote to your wealth plan.

Here is a breakdown of how much extra you need to earn to have $10,000 p/a to contribute to your wealth planning.

| Annual Income | Marginal Tax Rate (Inc 2% Medicare) | Extra Earnings Required to Save $10,000 |

| $75,000 | 34.5% | $15,267 |

| $125,000 | 39% | $16,393 |

| $200,000 | 47% | $18,868 |

#2: Zero doesn’t compound well.

Einstein said that “Compound Interest is the Eight Wonder of the World”. It’s a formula we all learn in school but unfortunately, not many of us truly grasp the importance of this concept. Maybe if it was explained to us in Benjamin Franklin’s words it would make a few more ears prick up…

“Money makes money.

And the money that money makes, makes more money”

Let me give you an example. If I asked you if you would prefer $1,000,000 today, or $0.01 which I would double every day for a month what would you say? As a youngster you would have said $1,000,000 hands down – you simply weren’t acquainted with compound interest yet. But being older and wiser you might recognise the ‘trick’ for what it was and select option B – after all, why all the drama to prove that you should have simply taken the $1,000,000? So then, it might not shock you to learn that option B is the more favourable choice, but it might shock you by how much….

After 30 days option B would have grown to $10,737,418.24, leaving you almost 11 x better off than simply taking the $1,000,000.

Now this is an extreme example, a CAGR of 100% is nigh on impossible for any meaningful length of time, but it serves its purpose well. Compounding your wealth at high rates of return for a long period of time can help you build exceptional wealth…. but you’ve got to have something to compound cause $0.00 doesn’t compound well! Saving is the habit you need here to ensure that there is a gap between your income and your expenses and that you have something meaningful to compound.

Here is an actual example from a real client – a 42 y/o School teacher. We recently sat down to talk about his wealth plan, and I remarked that it was fantastic that he was so far ahead with his super – a balance of >$400,000. He asked me “Why do I have so much super?”. I went on to explain that as a QLD government employee his employer withheld 5% of his pay by default as a salary sacrifice super contribution, and then matched it with a further 2.75% co-contribution. Adding this to the default 9.5% Super Guarantee payment which all employees receive, it resulted in 17.25% in super contributions, which was compounded at ~9.00% in a concessional tax environment for 20+ years… and Bob’s your uncle.

The 5.00% was essentially ‘forced saving’ – but it was so normal he didn’t even notice it. It has delivered a remarkable return on investment, and now that the ‘savings’ has done the heavy lifting through the early years compound interest will take it from here – the money that his money makes will make him more money.

#3: Regular Contributions Make a Massive Difference

Compound Interest is indeed the magical formula that allows wealth to grow miraculously….but the more of your own $ you add regularly, the better the results.

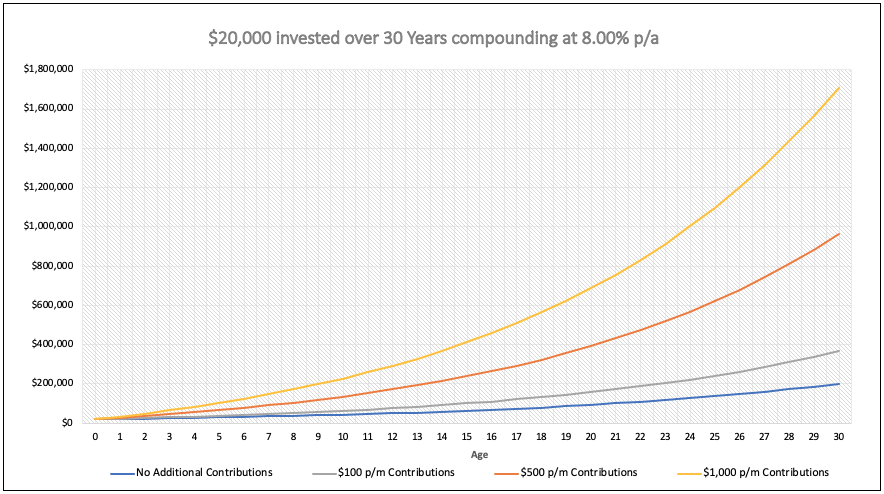

- The chart below shows that if $20,000 is compounded at 8.00% for 30 years it turns into a tidy sum of $201,253.

- However, if you give your wealth creation machine a small helping hand to the tune of $100 per month it turns into $367,751.

- Now let’s say there was a bigger gap between your income & your expenses (your savings) and you could add $500 per month… $963,894 is the size of the prize for committing to this habit.

- And finally, if you could add $1,000 p/m to your investment portfolio every month, 30 years later it is worth $1,709,704.

*Does not include the impact of taxation

*Does not include the impact of taxation

The habit of saving, and adding regularly to your investments has an exceptional reward associated with it – make a gap between your income and your expenses and put the savings to work!

#4: If you can’t save you’ll pay for your house twice!

I’ve always found it exceptionally interesting that the average Aussie seems to have a burning hatred for the taxman. We hate parting with our hard-earned $ in the form of income tax and will do just about anything to avoid it (including losing money on purpose… but that is an article for another day). What is even more perplexing though is that Aussies seem to have no issue handing that money over to the bank instead!

In fact, we seem to love bankers so much that many people will take a home mortgage, and then repay the bank twice what they borrow!

You see if interest rates were just 5.30% (which they were only a few short years ago and is below the 30-year average) and you only make the minimum repayments over a 30-year loan term you will literally repay the bank twice the amount you borrowed.

To put some numbers around it, if you borrowed $640,000 for an $800,000 house purchase (an 80% LVR) you will repay the bank $1,279,422 in total, and $639,422 in interest. Youch!

Having the capacity to save allows you to accelerate your debt repayment and save hundreds of thousands of dollars in interest!

#5: Do what you want, when you want, with who you want, for as long as you want.

One of the best uses for money I can possibly think of is buying time – the ability to do what you want, when you want, with who you want, for as long as you want. But in order to achieve this pinnacle of financial success, you need to able to accrue enough wealth to replace your income – or rather cover your expenses. ‘Saving’ is the key habit you’ll need to develop to get to this level – and the amount you need to commit to your wealth plan is a function of 5 things… what I call my “Wealth Creation Ingredients”.

- Capital

- Cashflow

- Time

- Risk

- Behaviour

Depending on the cost of your desired lifestyle, and the ingredients you have to work with, you’ll need to save varying amounts to get there. What is clear though, is that without saving (expressed as cash flow in the ingredients list above) this goal is probably just a pipe dream. If your expenses always = your income, and there is nothing left over for wealth creation you’ll always need to trade time for money. It doesn’t even matter what you earn – it could be $500,000 p/a, but if your expenses are $499,999 someone earning $80,000 p/a with expenses of $70,000 is going to stand a much better chance at achieving ‘Financial Freedom’.

As a side note, there is an inverse relationship between time & cashflow – The more time you have, the less you have to save so start today!!!

So, there you have it. My top 5 reasons to save – but remember, saving by itself won’t get you there. You’ll need to partner this simple habit with an appropriate strategy, and an effective investment plan.

If you’ve already got the habit down pat and you’re piling up money in the bank earning peanuts make a free appointment to discuss how we can build on your fantastic head-start and take your wealth plan to the next level.

If you’re not quite there yet hopefully my Top 5 Reasons to Save has convinced you to get started today! If it seems daunting start small and aim to increase your income/expense gap over time. (Hint – there are two ways you can do this – earn more and retain the same lifestyle, or earn the same and reduce your lifestyle). Don’t underestimate the power of habit, and making it ‘normal’.

All the best for an amazing and prosperous 2021. I hope to see you soon.

Saul.