In my work as a financial adviser an enormous proportion of my time is spent dispelling myths, misunderstandings, misconceptions, and unfortunately, just outright lies that clients have allowed to influence their financial decisions. There is an enormous array of reasons for these misunderstandings ranging from “my dad said…” to “I read on Facebook…”, but as with all situations where one makes important decisions based on misinformation, the outcomes are far from optimal, and in many cases… downright awful.

One of the most common misconceptions I see is that people mistake superannuation for an investment strategy – it kills me. So when I work out that this little misunderstanding is standing in the way of better outcomes for Mr & Mrs client, this is what I tell them.

“Superannuation is just a beautiful tax structure that the government provides to Australians for the purpose of investing and growing their wealth for retirement – with a few minor rules that dictate when you can access your capital. You get to control your investment strategy, and how your money is invested. You are the master of your own financial destiny.”

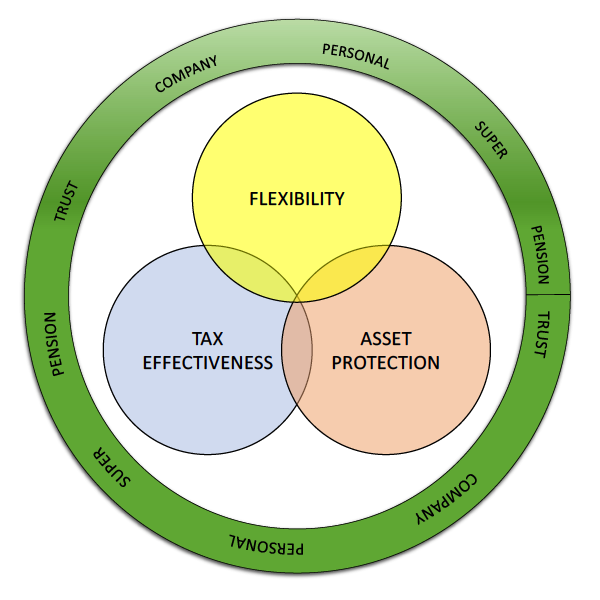

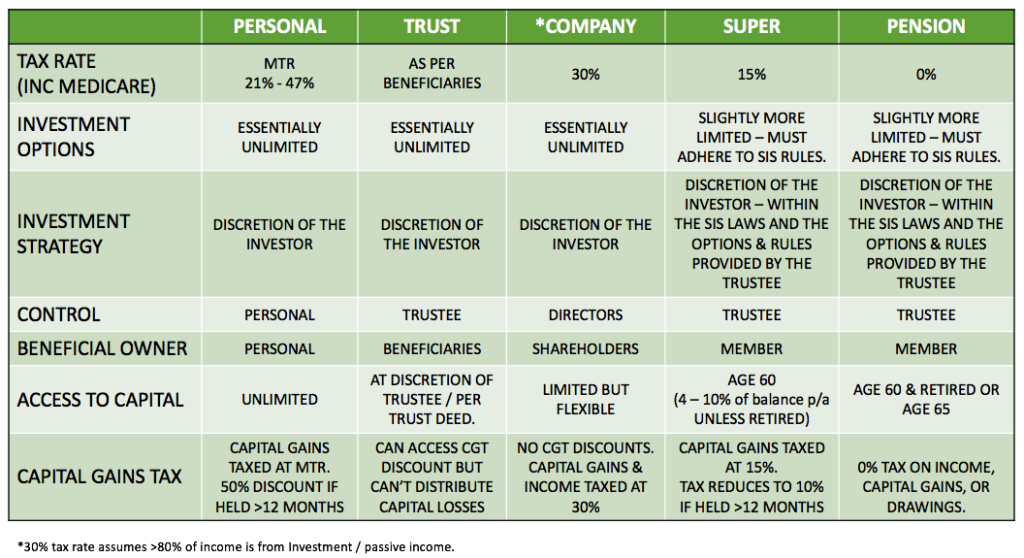

In fact, Super is but one of many structures you could use for your ‘investment vehicle’. You can invest in your personal name or your spouses, you can invest in a trust, a company, or the pension phase of your super (subject to age). Investors expend a great deal of effort about thinking what asset they want to invest in, but they typically eschew the all-important decision of which structure in which hold the assets, and I have to tell you – the risks of getting it wrong are costly, and the reward for getting it right is great!

So without further adieu, let’s have a look at some of the common structures available for investing & growing your wealth, as well as their pros and cons.

Personal names

The most simple and common ‘structure’ people choose to use to acquire investments.

PERSONAL TAX RATES

| Taxable Income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $90,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $90,001 – $180,000 | $20,797 plus 37c for each $1 over $90,000 |

| $180,001 and over | $54,097 plus 45c for each $1 over $180,000 |

Pros:

- Simple

- No extra tax returns / compliance

- Can invest in either spouses name, or both

- Personal Tax free threshold is useful in retirement when all income is passive.

- Invest in whatever you like, whenever you like, however you like (unfortunately this also belongs on the cons list, and is the downfall of many investors!)

Cons:

- The personal tax rate is the highest of all structures for investors earning >$37,000 from employment / running a business.

- No asset protection – all personal assets could be subject to challenge in the event of death, legal issues, business, or financial troubles.

(Discretionary) Trusts

A Discretionary trust does not have a Tax rate in and of itself – all profits of a trust must be disbursed to its beneficiaries each and every year.

Pros:

- Asset Protection – Beneficiaries have no present entitlement to the assets of the trust (they have no ‘ownership’ so the assets of a trust may be protected in the event of death, legal issues, business, or financial troubles.

- Ability to disperse the income & capital gains of the trust to the most tax-effective beneficiaries – in any proportion the trustee would like.

- Ability to disperse capital gains separately to income (handy in the event that one beneficiary has unused capital losses, and another has lower income)

- Invest in whatever you like, whenever you like, however you like (unfortunately this also belongs on the cons list, and is the downfall of many investors!)

- Ability to include a range of beneficiaries – spouses, children, grandchildren, etc – allows expenses of beneficiaries to be funded from trust profits using their marginal tax rate, not yours. ie: an 18 – 22 y/o at Uni may have $0.00 assessable income, and could receive $18,200 in trust distributions to fund Uni expenses with no tax implications.

- Invest in whatever you like, whenever you like, however you like (unfortunately this also belongs on the cons list, and is the downfall of many investors!)

Cons:

- Added complexity

- The trust needs to complete a tax return every year – extra running costs

- Profits must be disbursed to beneficiaries every year

- Capital losses cannot be disbursed to beneficiaries – they are ‘trapped’ within the trust and must be recouped through profits.

- All actions of the trustee must be in compliance with the rules allowed under the trust deed.

- The ‘Appointer’ of a trust holds the ultimate power – the only role they have is the ability to hire & fire the Trustee (Choose your Trust roles carefully)

- No eligibility for land tax concessions for property investors (as per individuals) – varies state to state so do your homework.

companies

Investing in a company is completely possible – and in fact, it is a favoured structure for many fund managers. A LIC (Listed Investment Company) is a company whose sole source of revenue & profit is from investing and is listed on a stock exchange (like the ASX). Investors can buy shares in the company, and benefit from capital growth & dividends – should the company directors choose to pay them.

Pros:

- Tax is levied at the company tax rate – 30%, so wealth may be accrued in more favourable structures.

- No CGT discount – may positively influence investor behavior (less likely to hold poor investments simply to access CGT discounts)

- Asset protection – a company may have limited liability, meaning there is no recourse for investors, shareholders, or directors (to a slightly lesser extent)

- Ability to loan money to other structures, or shareholders

- Shareholders can be other structures (such as trusts)

- Can pay fully franked dividends to shareholders (credits for the tax already paid at the company tax rate of 30%)

Cons:

- Increased complexity

- No capital gains tax discounts – all income & capital gains taxed at 30%.

- No eligibility for land tax concessions for property investors (as per individuals) – varies state to state so do your homework.

- Limited options to distribute profits to shareholders – no ability to distribute with discretion.

- Getting money out of a company structure ta effectively can be tricky – be mindful of who the shareholders are and what their marginal tax rate is.

- (Div 7A) loans need to be repaid to the company – with interest.

SUPERANNUATION (ACCUMULATION PHASE)

In terms of a tax structure to invest in, there is no competition…. super is the most favourable – hands down. However, you may not like the tradeoffs…

Pros:

- Income (dividends, and other investment income) taxed at 15%

- CGT discount of 33.33% for investments held >12 months – an effective rate of 10%!!!

- Contributions to super reduce your taxable income.

- You have control over your investment strategy – you can invest in Shares, Property, Bonds, Cash, Alternative Assets, Wine, Whiskey, Art, Credit markets… there really aren’t many limitations – Super is not an investment strategy in and of itself. You have control of your financial future!

- The government forces super trustees to have an investment strategy, to document it, and to ‘consider’ diversification – trust me, having some rules (self-imposed or otherwise) is a positive!

- Make it as simple or complex as you like – remember, you’re in control!

- Super does not form part of your estate – it will go to whomever you have nominated to receive your benefits – provide you’ve made a binding nomination and it is valid.

Cons:

- Heavily politicized – There is a disgusting amount of misinformation, lopsided advertising, and propaganda out there.

- Preservation age (when you can access it) is 60 for most people. alternatively, accessing super requires you to meet a ‘condition of release’.

- The government might move the goalposts and change contribution limits or preservation ages (though any changes are likely to affect younger workers more so than those closer to age 60)

- There is only so much you can get into this beautiful concessionally taxed environment

- If you choose the easy option (simple pre-fab industry or retail super funds) you relinquish a lot of control.

- If you retain control (by using more complex DIY retail platforms or SMSF’s) you run the risk of underperforming the experts running the ‘pre-fab’ option.

- It is shockingly difficult to compare apples with apples in terms of fund fees, asset allocations, and overall results net of fees – the regulator has a lot to answer for here.

- Adult (non-dependent) beneficiaries who receive super death benefits are taxed at 15% (+ medicare) of the ‘taxable component’.

SUPERANNUATION (pension PHASE)

Once you’ve reached preservation age and retired you call roll your super into an “Account-Based Pension”. This moves your super assets into a 0% tax environment designed to help your capital last throughout retirement.

Pros:

- As above – with 0% Tax on income, capital gains, or withdrawals.

Cons:

There really aren’t many in pension phase – your pension account can effectively be like a bank account – with no tax implications.

- You must make annual withdrawals of 5% of your balance after age 65 – rising with age.

- You don’t have a job anymore, so you need to make your retirement capital a) generate income, and b) last – you need a more considered and complex investment strategy.

The importance of structuring

When I see clients who have made good headway on their mortgage, and are beginning to accumulate assets for the future, its never as simple as dumping funds into super or simply commencing an outside super investment. There are a whole raft of considerations and implications – tax implications, asset protection considerations, buy / sell cost implications, and there are also succession & estate planning considerations.

The right combination of investments & structures is absolutely critical to long-term wealth creation – whether that is simply for a joyful and stress-free retirement, an early exit from ‘the rat race’, or long-term intergenerational wealth creation & protection, so seek advice and get the right wealth creation plan for your unique circumstances.