Have you ever opened your broker app, or your portfolio tracker and seen a significant unexplainable drop in the value of your investment? Did you have one of these reactions….?

Then did you go into a mad scramble googling the ticker code, checking Hot Copper, or trawling through Google news to find some explanation? If you were lucky, finally on Hot Copper or some other stock forum someone who’s been around investing a bit longer than you calmly says “Chill out there young fella – its just gone ex-dividend” (or ex distribution in the case of managed funds).

Well thats great you think – but what the heck does that mean? I’m still down 8% overnight! Well, here you go – your quick guide to dividends, distributions, and re-investment plans.

Lets start at the company level…

A company is owned by shareholders, but run by a board of directors (B.O.D) and a management team. If the business turns a profit, the B.O.D has a choice about what to do with those profits – retain them for use in the business (growth, reinvestment & expansion), or give them to shareholders in the form of a dividend – or some combination of the two. In the case of a young and growing company there may be plenty of good opportunities to reinvest capital and achieve high rates of return, but for a more mature company (Telstra for example) they may have run out of growth runway, and decide the best thing to do with profits is to give them back to their shareholders in the form of dividends. When this occurs, there is some terminology you’ll need to become familiar with:

EPS: Earnings Per Share – The NPAT of the company divided by the number of shares on issue.

DPR: Dividend Payout Ratio – The percentage of NPAT paid to shareholders as dividends, this might be a predefined % that is set by the board.

Record Date – The date that is used to establish shareholders entitlement to receive the dividend. If you are on the shareholders register on this date you will receive the dividend. If you are not, you wont. The record date for the ASX is 5:00pm on the day prior to the Ex-dividend date.

Ex-Dividend Date – Essentially the date that the dividend is deemed paid (though the actual payment date is usually weeks later). In a perfectly efficient and rational market, on the ex-dividend date a companies share price will drop by the value of the dividend to be paid. Think of it like the company moving cash from their balance sheet to your bank account – if the company can no longer call the cash theirs, it cant be used in the company valuation either.

Cum Dividend: If a stock is trading before its ex-dividend date (Ie, with an entitlement to receive the dividend) it is said to be trading Cum dividend.

DRP: Dividend re-investment plan: A company may offer shareholders a choice of taking their dividend as cash, or reinvesting it in new shares in the company – they may offer a small discount as an incentive for shareholders to participate in the DRP.

Lets have a look at a worked example:

BHP is trading at $32.00 per share, and they’ve had a cracker year – They have earned $2.30 EPS and decide they don’t need all of the profits reinvested, so in accordance with their dividend payout ratio they will payout 70% of profits to shareholders – $1.61 per share or 5.03%. Along with their annual report, BHP releases a dividend declaration stating the payment amounts, the record date, the ex date, and the payment date. On the ex-dividend date BHP’s share price *should drop by $1.61 to reflect the fact that the money will be moved from their balance sheet to shareholder bank accounts.

*Investors and markets aren’t always rational or perfectly efficient so the drop may be larger or smaller depending on what Mr market is feeling like on the day.

If a shareholder owns 1000 BHP Shares worth $32,000 they would receive a $1,610 dividend. BHP have declared that the DRP price is $30.39. After the ex-dividend date, a shareholder who elects to take the dividend in cash would have $30,390 in BHP shares, and an entitlement to receive $1,610 in cash (a total sum of $32,000)….but it might look a bit funny till the cash actually shows up in the bank. A shareholder who participates in the DRP would have 1000 old BHP shares worth $30.39 each + and entitlement to receive 53 new BHP shares worth $30.39 each – a total of $32,000…. but it might look a bit funny till the dividend payment date when the new shares are actually issued.

Feeling calmer yet?

Fantastic – lets look at how dividends / distributions work for managed funds.

MANAGED FUND Distributions:

A managed fund is a trust fund – a unit trust specifically. Managed funds don’t have shareholders, they have unit holders. Each unit represents an equal entitlement to the income and capital of the trust. The difference with a trust and a company is that a company can choose to pay dividends to shareholders (or not), and specify the amount of the dividends. A trust MUST distribute ALL income (dividends) and capital gains to unit holders each and every tax year year. So if you’re the unit holder of a managed fund that pays distributions annually, expect a drop in the unit price on June 30th every year (assuming the fund makes income or capital gains).

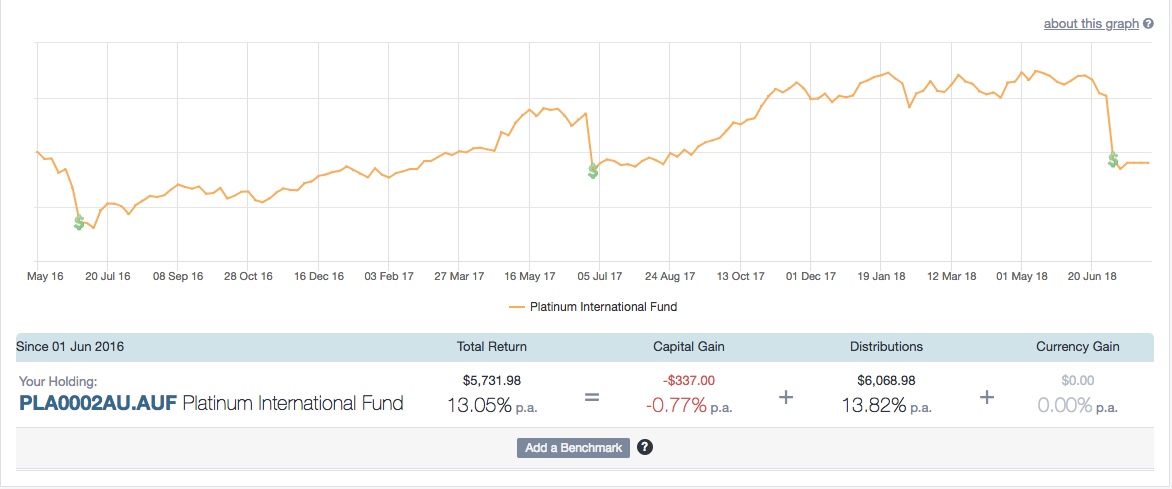

To articulate, check out what has happened to the Platinum International Fund unit price every June 30th for the last 3 years.

The financial year ticks over and Platinum begins with no undistributed income or capital gains (note, they may still have unrealised capital gains – they can’t distribute profits that haven’t been realised yet). They set about their business doing what they do best – investing in companies. These companies grow in value, and pay dividends – all of which is reflected in the unit price (what the graph above represents), then we get to June 30th and bang – the unit price plummets as Platinum declares a distribution and the underlying income and capital gains from the fund are distributed to unit holders. Unit holders can now take the cash, or reinvest distributions.

The Platinum distribution this year was particularly high – as you can see from the chart. This suggests to me that they locked in significant capital gains on their underlying investments. It may also mean that there is now less unrealised capital gains within the fund. Funds may pay distributions yearly, half-yearly, quarterly or monthly depending on the nature of their underlying investments and the purpose of the fund. For example, a REIT that receives rental income from tenants weekly may pay distributions monthly, where as a fund that invests in undervalued growth stocks and holds them for the long term might pay lumpy yearly dividends that vary depending on when they sell stocks and ‘lock in’ profits.

When you buy units in a managed fund, you’re buying the funds underlying investments, their cash, their realised capital gains, their unrealised capital gains, their foreign income – the works, and often without a great deal of transparency about the makeup of the value of the unit price.

Unlike dividends, which are just plain old income, Managed Fund distributions are split out into their underlying components – Franked dividends, unfranked dividends, short term capital gains, long term capital gains, foreign income etc etc, all of which needs to be declared on your tax return. On June 29th if you purchased units in a managed fund that will pay a 10% distribution , on June 30th the unit price will take a 10% hit. But thats alright, you’ve read this article so you know there is no cause for alarm, its just a distribution – there will be a net 0 result. Well thats true… except for the tax implications.

You see, you just paid $50,000 for units in the fund. The next day your units are worth $45,000, but you get $5,000 in the bank… except that $5,000 is made up of franked dividends, unfranked dividends, short term capital gains, long term capital gains, foreign income etc etc……all of which needs to be declared on your tax return. You’re essentially paying tax on someone else’s profits. *It might be a better idea to wait till July 1st.

*Don’t get too caught up on timing your entry into managed funds though – they are intended to be long-term investments, and as long as your fund manager performs you won’t care who’s profits you’re paying tax on. Besides, unless it been reported you won’t know the underlying realised / unrealised gains within the unit price so you could be trying to time your entry for nothing.

We’ll get into franking credits, whether or not DRP’s are worthwhile, and continue down the rabbit hole in future articles but for now that should give you a good overview of dividends, distributions and reinvestment. Till next time, happy investing.

Saul.