If i were to ask you what your ‘Investor Risk Profile’ is would your face look something like this? Thats alright, don’t stress… most peoples would (albeit with a bit more hair and a few wrinkles).

What if i told you that around 75 – 80% of your investment returns were inextricably linked to your risk profile… would you want to know what yours is then?

You see this super smart bloke back in 1952 named Harry Markowitz used 14 pieces of paper to write an industry changing thesis that a cheeky young blogger would one day sum up in 2 succinct idioms (no disrespect Harry).

- “Don’t put all your eggs in one basket”

- “Nothing ventured, nothing gained”

Essentially in his thesis, Markowitz mathematically proved that investment risk & investment returns were two sides of the same coin…

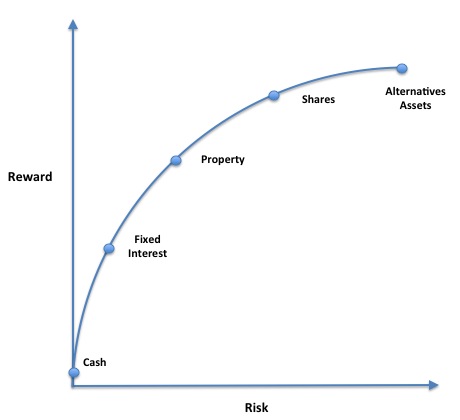

In order to achieve higher investment returns, you had to move further up the risk curve – conversely, if you wanted to move further down the risk curve, you could expect your investment returns to diminish.”Modern Portfolio Theory” (MPT) was born, and is still today the basis upon which financial planners match suitable investments with clients.

To give you a bit of an appreciation of the risk / reward curve, the graph below lays out the major investment ‘asset classes’ and where they sit on the risk / reward curve.

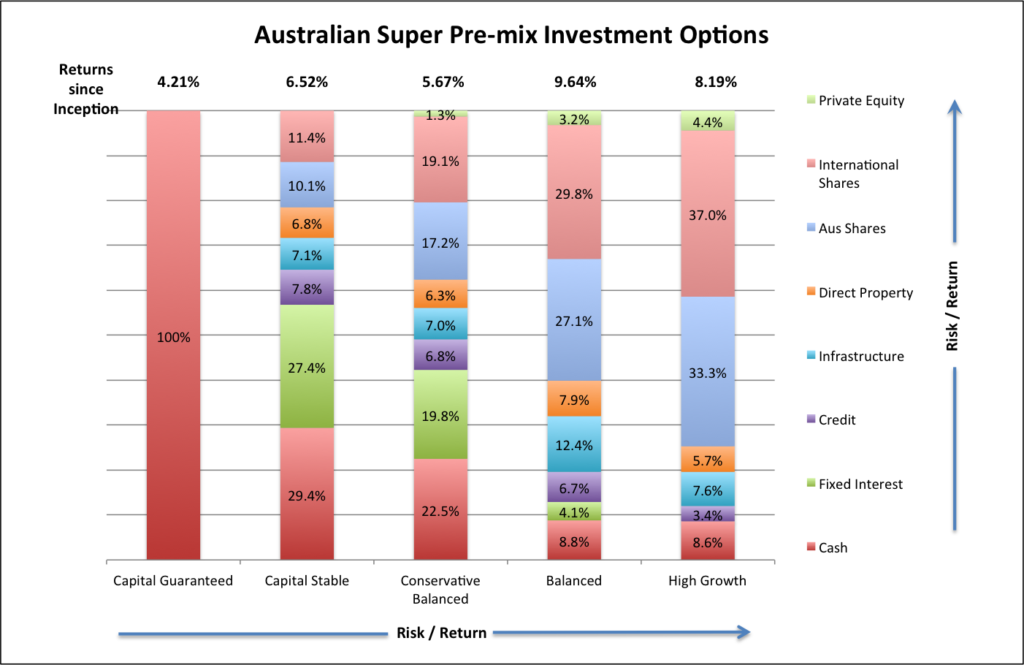

Modern Portfolio Theory essentially aims to construct a portfolio of assets that provides the maximum possible return for a particular investor’s risk profile. The diagram below shows Australian Super’s pre-mix investment options and their % exposure to various asset classes. Cash, the lowest risk asset class makes up less and less of a portfolio as the Investment Option increases in its risk / reward profile. Conversely, shares make up a larger proportion of a portfolio as the risk / reward profile increases.

What you’ll also find if you go digging is additional information about the each investment option, including its relative risk, its investment aim, and how frequently the portfolio might experience a loss. the info below is taken from the ‘Balanced’ option.

Summary: Invests in a wide range of assets. Designed to have medium to long-term growth with possible short-term fluctuations.

Investment Aims:

- To beat CPI by 4% pa over the medium to longer term.

- To beat the median balanced fund over the medium to longer term.

Minimum investment timeframe: At least 10 years.

Risk Level for the Time Invested:

| Short-term | Medium-term | Long-term |

| High | Medium | Low to medium |

Risk of Negative Return: About 5 in every 20 years.

Well that covers our “Nothing Ventured, Nothing Gained” idiom, so what about “Don’t put all your eggs in one basket?”. Idiom #2 is one of the primary methods of mitigating risk in investing & financial planning… diversification. The underlying principal is that the returns from different asset classes have their highs and lows at different times, and under different economic conditions, so spreading a portfolios exposure across multiple asset classes means that poor performance (or heaven forbid, a crash) in any one of the asset classes will not overly impact the entire portfolio. Lets have a look at an example:

The tables below compare two hypothetical portfolios – the first, a well diversified portfolio with a ‘balanced’ profile, and the second, a portfolio with a high allocation to property (Australians love their property, and many are ‘overweight’ this asset class)

Lets say an overheated property market has a bit of a correction and drops by 8%. Both portfolios are adversely affected, but our balanced portfolio has faired much better, outperforming our overweight property portfolio by 7.1%.

| Portfolio 1 – “Balanced” | ||

| Asset Class | Allocation | Returns |

| International shares | 28% | 7% |

| Australian Shares | 35% | 6% |

| Property | 15% | -8% |

| Fixed Interest | 12% | 3% |

| Cash | 10% | 2.50% |

| Portfolio Returns | 3.47% | |

| Portfolio 2 – “Overweight Property” | ||

| Asset Class | Allocation | Returns |

| International shares | 0% | 0% |

| Australian Shares | 20% | 6% |

| Property | 65% | -8% |

| Fixed Interest | 0.0% | 3% |

| Cash | 15% | 2.50% |

| Portfolio Returns | -3.63% | |

Now, this doesn’t mean that i’m opposed to property investing (quite the opposite in fact). It is simply an example of how a downturn in one asset class can have a major adverse impact on an inadequately diversified portfolio. The example could just as easily have been made with any number of scenarios that could impact various assets classes…

- Trump gets impeached, and international shares take a dive

- The RBA starts raising interest rates, and investor start leaving Australian shares in favour of rising yields from cash deposits.

- Overheated Sydney & Melbourne property markets start cooling off.

- Iron ore prices tank and Australian shares drop.

The point is you can’t gaze into a crystal ball, foresee the likelihood of any of these events occurring and adjust your portfolio accordingly, so the best option you’ve got is diversification.

Risk v’s Reward in investing is all about achieving the best returns you can whilst still being able to sleep at night – and managing that tricky balance relies on a few things:

- Know your Investor / Risk profile

- Know what your investment goals are

- Know what your investment timeframe is

- Make sure your portfolios is adequately diversified.

Before you go and start reconfiguring your portfolio, be sure to see an authorised financial planner. A good planner will undertake a comprehensive analysis of of your unique personal circumstances to ensure that your plan achieves your investment goals… and helps you sleep at night.

For a more comprehensive look at diversification, ASIC’s Money Smart has a fantastic page here

For an example of a ‘risk profile questionaire’, check out BT Investments risk profiler here