In 1972, a Stanford University psychology professor named Walter Mischel ran an incredible, but simple experiment. A child was given a small treat – in this case they could choose between a Marshmallow or a pretzel (whichever they preferred). They were told that they could eat the treat any time they liked, or…. if they managed not to eat the treat and waited for the researcher to return 15 minutes later, they could have a second one. The researcher left the room and watched with interest.

So what happened?

Well, as you may have guessed some of the kids ate their Marshmallow immediately, others wrestled with the overwhelming desire to taste the sweet fluffy goodness for a few minutes and then caved, and some managed to go the distance and collect their reward – a second treat!

Now where things get really interesting is the results of follow up studies that checked in with the original participants in their adolescent, and adult lives.

“Researchers found that children who were able to wait longer for the preferred rewards tended to have better life outcomes, as measured by SAT scores, educational attainment, body mass index (BMI), and other life measures”

If you can resist a brand new car, delay your house renovations or upgrade, or push back that big expensive holiday by a few years, you could save tens of thousands of dollars – and in some cases, hundreds of thousands.

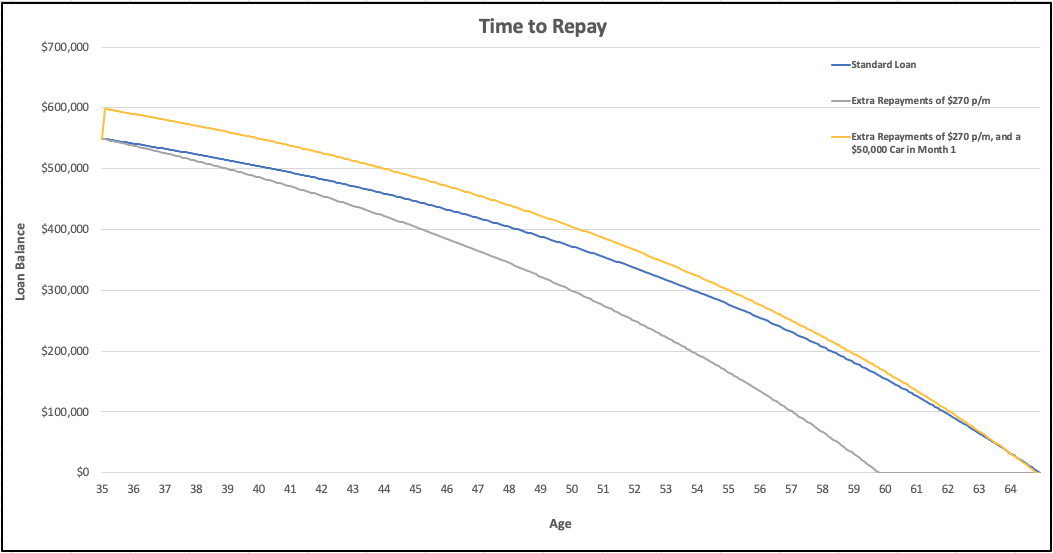

The graph below shows the ‘Debt Journey’ of a homeowner who starts with $550,000 debt at age 35, and in month one also adds on a new $50,000 car. They figure they’ll pay extra off the home loan to ‘catch up’ – in this case, $270.00 p/m in extra repayments.

BUYING A NEW $50,000 CAR AT THE START OF THE ‘DEBT JOURNEY’

Interest rate of 5.0% (since today’s lower rates are unlikely to persist over a full 30 -year debt journey)

Interest rate of 5.0% (since today’s lower rates are unlikely to persist over a full 30 -year debt journey)

The blue line represents the journey if they simply made the minimum repayments over the life of the loan.

The grey line represents the journey if they simply paid off an extra $270.00 p/m. A saving of 5 years, and $100,478 in interest vs making the minimum repayment.

The yellow line represents the debt journey if the $50,000 car was purchased in month 1 – this results in an extra $44,027 in interest vs the standard journey (with no extra repayments), and an extra $144,504 vs not buying the car, but continuing to make the extra repayments.

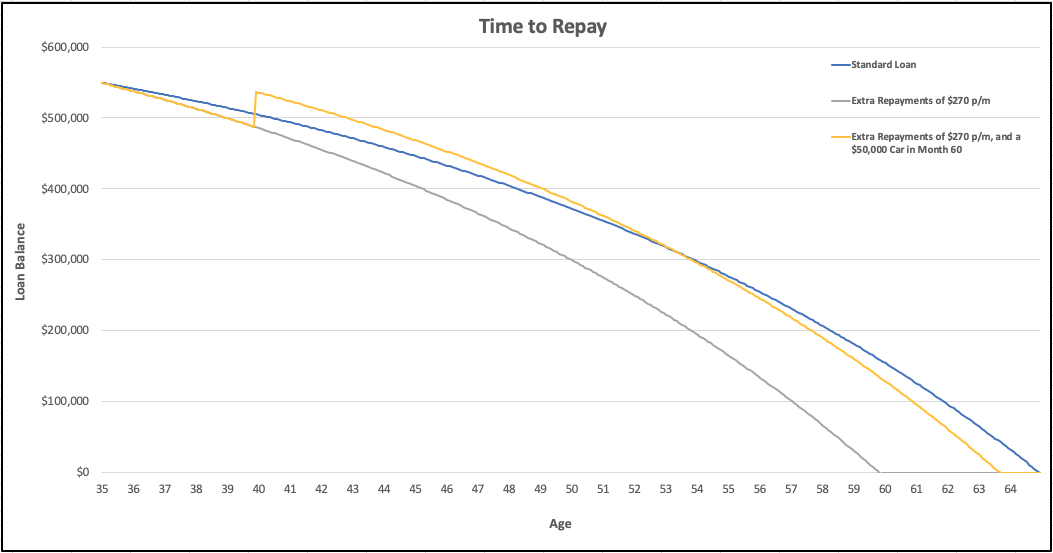

Now I completely appreciate that people need motor vehicles, don’t get me wrong, I’m not the fun police. But what if we compromised a bit, and delayed gratification by 5 years. Let’s push out our new car purchase to Month 60. Here is what that looks like.

BUYING A NEW $50,000 CAR IN YEAR 6 OF THE ‘DEBT JOURNEY’

This simple little change results in a $45,984 Interest Saving vs buying the new car right from the start.

This simple little change results in a $45,984 Interest Saving vs buying the new car right from the start.

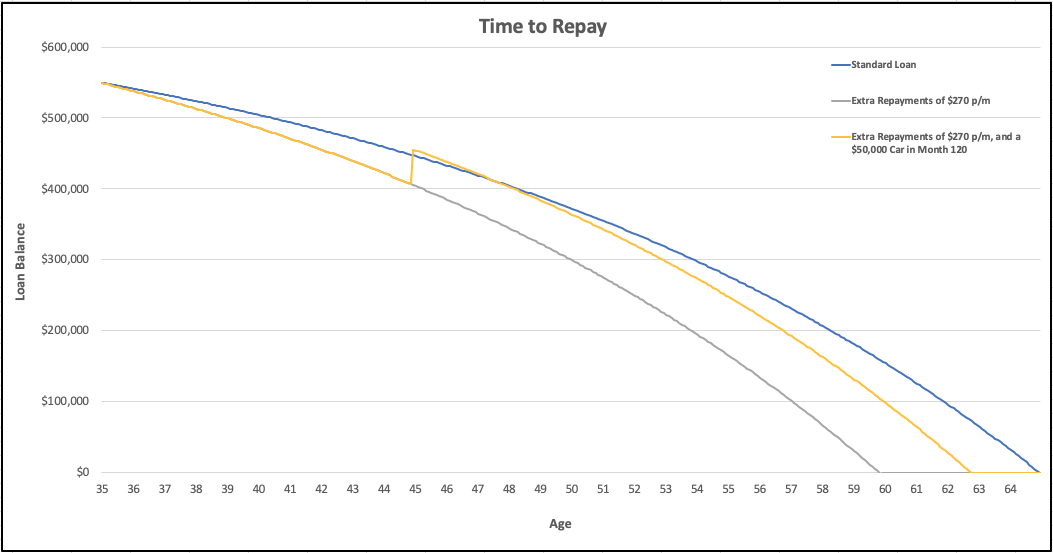

What if we managed to delay gratification for another 5 years, and reward ourselves after 10 years of extra home repayments? This is what it looks like delaying the $50,000 car purchase until month 120 of the debt journey.

BUYING A NEW $50,000 CAR IN YEAR 11 OF THE ‘DEBT JOURNEY’

By moving the car purchase to year 10, it results in $81,512 in Interest Savings vs buying the car in Month 1.

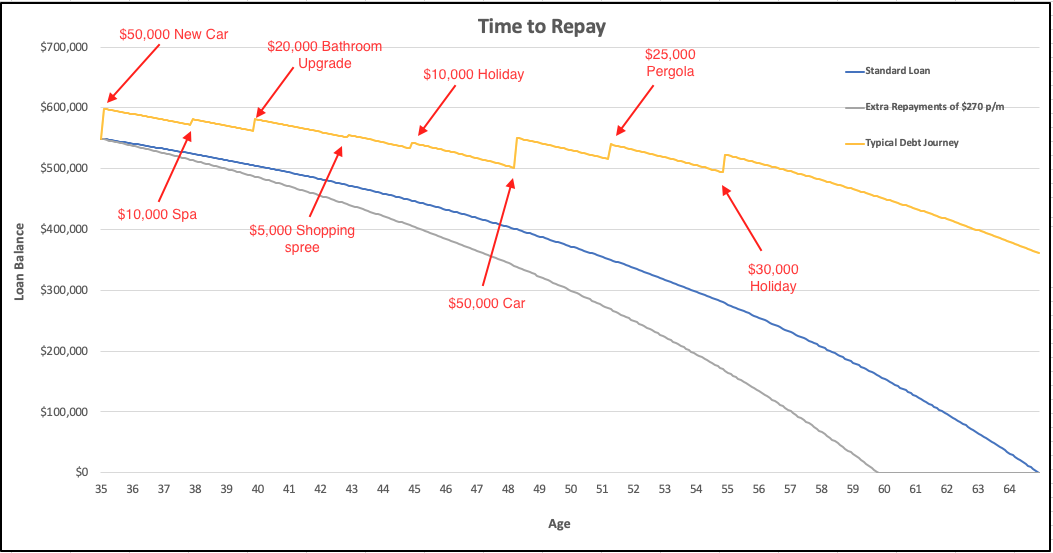

Unfortunately, the average homeowner loves Marshmallows a little too much, so rather than delaying gratification they keep dipping into their home loan redraw, or worse, refinancing and using equity for a few big-ticket items along the debt journey.

THE COST OF FAILING TO RESIST MARSHMALLOWS

This kind of a debt journey is pretty common in Australia, and its largely due to a couple of things.

This kind of a debt journey is pretty common in Australia, and its largely due to a couple of things.

-

- An inability to delay gratification

- Not fully understanding the implications of the decisions.

The debt journey above has $200,000 worth of lump-sum purchases along the way, but unbeknownst to the protagonist in this little debt story,

It will cost them $358,412 in extra interest (on top of the $200,000) as at the end of a standard 30-year loan…except its not the end of the journey for them – the loan balance will still be $360,734 at this point.

It’s easy to see why so many Australians are carrying high debt levels into retirement – and then pummelling their super balance simply to become debt-free.

Now what we’ve just looked at is an example of the savings that can be achieved by delaying gratification and expediting your debt journey… but I promised you bigger rewards than that… I promised I’d make you rich!

Imagine that instead of saving 5% in interest by simply paying down your home loan, you got a bit more assertive and started investing.

DELAYING GRATIFICATION TO BUILD AN INVESTMENT PORTFOLIO

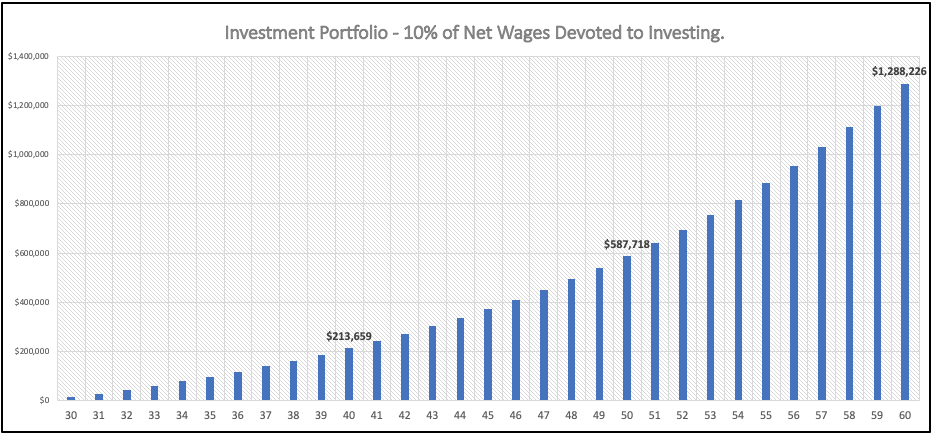

The chart below shows the growth of an investment portfolio started by an average 30 y/o Aussie couple – let’s call them Brad & Amy. Brad & Amy had aspirations of building wealth to provide a stress-free and comfortable lifestyle for themselves & their kids. What they decided to do was to give themselves a self-imposed 10% pay cut and devote the proceeds to building an investment portfolio. Her gross wage of $120,000 p/a, and his gross wage of $65,000 produced $136,731 in annual after-tax income, so they set up a portfolio and devoted $13,673 p/a to it – regular monthly contributions of $1,140 p/m that simply disappeared before they got the chance to spend it….. and this is what happened.

$13,673 p/a in contributions with distributions reinvested.

$13,673 p/a in contributions with distributions reinvested.

- At age 40, 10 years after establishing their investment portfolio they’ve accumulated a nice little $213,659 nest egg – in addition to paying down the debt on their family home.

- At age 50, after delaying gratification for another 10 years their portfolio has increased by 275% to $587,718.

- At Age 60 they have accumulated a portfolio with a value of $1,288,226 – all from living on 90% of their earnings, and not touching their nest egg so it could grow.

A little bit of delayed gratification goes a long way!

Financial Advice & Financial planning is not about depriving you of life’s joys and luxuries so your 65-year old self can be wealthy. It’s about finding a compromise, and getting the balance right so you can enjoy the right lifestyle at all stages of life. If you play your cards right and get the right advice you can have your cake and eat it too.

If you think that you can resist some of life’s tempting marshmallow moments book in for a free 20-minute financial snapshot – I’d love to talk about your personal wealth goals, and how we can help you achieve them.

I look forward to hearing from you soon.

Saul.