Everybody loves that feeling of being ‘cashed up’ – you’ve just finished a huge job and a client has just squared their enormous bill, or you’ve had a windfall at two-up, maybe you’ve sold a house, or perhaps you’ve saved hard and hit a milestone.

However you got there, you love that feeling…. perhaps so much that you don’t want to lose it – you want to lock it up, keep it safe, protect it from sneaky little Hobitses…

OK, so maybe you’re not that bad. But if you’re like many Australian investors, you may be holding too much cash in your investment portfolio, and it may be costing you more that you know.

‘What do you mean? Cash doesn’t cost you anything i hear you say – in fact my cash in the bank is earning me 2.5% p.a interest’.

Well that may be true, but the cost of a ‘basket of goods and services’ is getting more expensive at a rate of ~1.9% according to the latest consumer price index (CPI) data from the ABS. That means that once your 2.5% interest is taxed at ~30%, you’re left with 1.75%, which then doesn’t even purchase you same amount of stuff it did last year…..

So whilst the balance that displays on the ATM, or the amount of $100 bills stuffed under your mattress isn’t getting any smaller, its value (purchasing power) is diminishing and allowing you to buy less and less each year. Remember when a meat pie was $2.00? or even $1.00?… god those were the days. I digress. This article isn’t about the glory days of $1.00 bakery snacks. Suffice it to say that too much cash isn’t helping grow your wealth. In fact, its helping you stand still, or perhaps even go backwards.

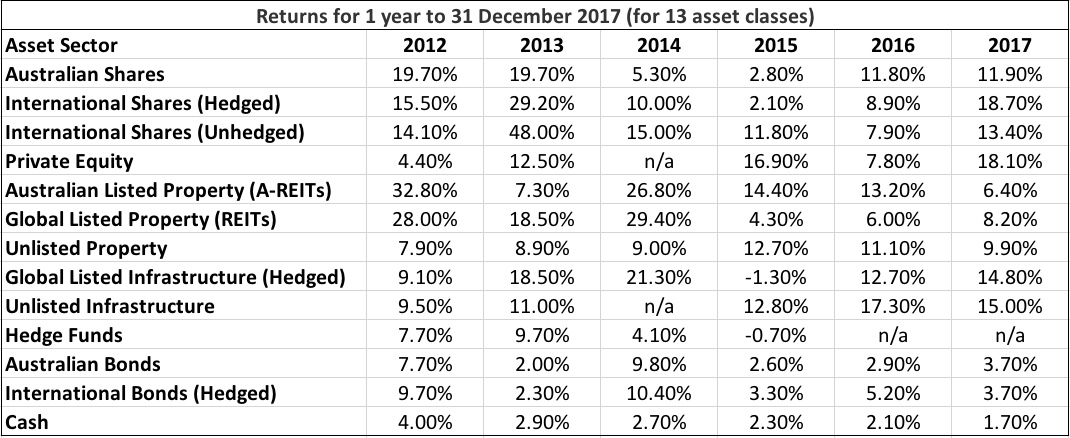

The other cost i refer to is opportunity cost. While your cash was sitting under you mattress, or in the bank earning 2.5% in 2017, (which is being generous) here’s what you missed out on.

Source: Chant West media releases over the past 7 years (www.chantwest.com.au) via Superguide

Now i’m really sorry. I apologise upfront, but you also missed out on similar returns from 2012 – 2016 as well.

The point here is not that cash is bad, its just to highlight that it plays a different role in your general life (buying goods & services), than in your investment portfolio (intended for building your wealth). If you need it in the short term for buying things, the rate of return you’re getting is a moot point, you’re going to spend it anyway. However, if you don’t need access to it for >3 years, it may as well be working harder for you.

So how much cash should you hold in your investment portfolio?

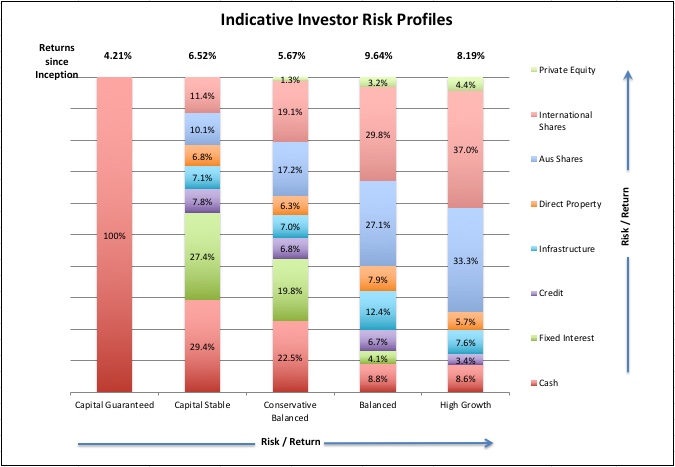

Well this is very personal, and needs to be tailored to an individual investor’s investment timeframe, personal situation, and appetite for & ability to accept risk. That said, there are some generally accepted broad ranges for each ‘risk profile’. Here is an example.

*indicative ranges only. Sourced from Australian Super pre-mixed portfolios 6th Aug 2017.

OK, so now that i’ve got you thinking about that big chunk of cash in your account and what to do with it, lets have a look at what actually makes up your investment portfolio, and how much cash is really in it. The way i think about it is, if i have enough cash to cover my short term living expenses, and 3 months worth of expenses as an emergency fund, everything else is part & parcel of my investment portfolio. That means i need to consider how everything else is working for me (including any lumps of cash sitting around).

I make this point because its easy to mentally carve off a chunk of cash, set it aside and not consider it part of your portfolio. But not considering part of your investible assets might be hindering your overall returns.

Here is an example.

Total Investible Assets: $100,000

Investment Portfolio (AUS Shares): $45,000

Cash for investment in portfolio: $5,000

Cash in bank: $50,000 (You don’t consider this part of your ‘investment portfolio’)

Lets say you have a cracker year with your share portfolio, and you outperform the index, achieving a return of 10.5%. Fantastic effort, but now lets calculate the return on your $100K investible assets (which includes the chunk of cash you carved off). Assuming your cash earns 2.5% interest, your real returns are:

Shares: ($100K x 45% x 10.5%) Plus

Portfolio cash: ($100K x 5% x 2.5%) Plus

Carved off Cash: ($100K x 50% x 2.5%) Equals $4,975, or 4.975%

Not quite as impressive huh?

Now lets look at another example:

You know know that holding too much cash is detrimental to your long term returns, so you decide to invest a larger % of your investible assets in shares. Because you know that there are experts out there who invest for a living, you decide to use a professional fund manager, who manages a portfolio of Australian shares. You also decide that for prudence, you need 15% cash in your portfolio, so you structure it as follows:

Managed Australian Share Fund: $85,000

Cash: $15,000.

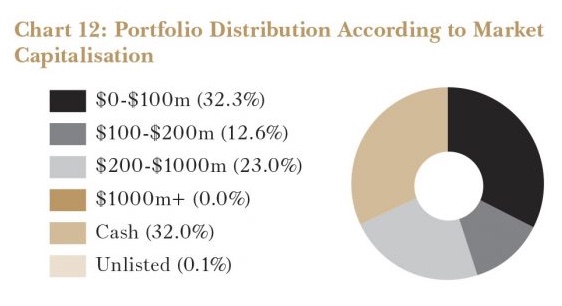

What you may not have realised is that this isn’t your fund manager’s first rodeo, and they are also thinking about their asset allocation, and how much cash they need in their portfolios. Here are 2 examples from March 31st quarterly reports:

WAM Capital (ASX: WAM)

Forager Funds Australian Share Fund (ASX: FOR)

Both of these funds are currently holding >30% Cash! (Both fund managers are renowned ‘Value Investors’, and they only buy shares when they’re on special – they obviously believe there aren’t many bargains at the moment).

Lets say your fund manager is holding 30% cash in their portfolio, and you are holding 15% in yours. What this really means is that your current cash weighting is:

Managed Fund Portfolio Cash: (85% x 30%) Plus

Your portfolio cash: 15% Equals 40.5% total cash weighting.

So i guess at this point you need to ask yourself if you or your fund manager is in a better position to make decisions about how and when to allocate your cash to investments, and if there is a superfluous layer of cash allocation in your portfolio. (Mind you this is only true of Active fund managers who have the ability to change the asset class allocations within their portfolios).

The father of modern portfolio theory, Howard Markowitz tells us that the largest contributing factor to our portfolio return is asset allocation – not necessarily the nitty gritty mix of individual investments within each asset class. Your cash weighting is one one those asset classes and in todays low interest rate environment, too higher cash weighting has the potential to cause a major drag on your overall investment returns.

This is not to say that you need to skip a few rungs on the risk ladder and jump straight to direct shares. If i refer back to the asset class returns for 2017 earlier in this article, the second worst performing (and second ‘safest’) asset class was International Bonds (currency hedged). This asset class returned 3.7% vs 1.7% from investing in cash. A 2% difference might not seem like much, but remember, 3.7% is 117.6% higher than 1.7%!!!

To put that in perspective, if you were a pensioner with $1,000,000 in assets on which to generate income to live off, 1.7% would earn you $17,000 per year. A meagre 2% increase in returns to 3.7% means you generate $37,000!!! That makes quite the difference to your retirement lifestyle.

So if you are holding cash that you don’t immediately need, and you don’t really consider part of your ‘investment portfolio’, you may be doing yourself a disservice. There are many ways to increase your returns and manage your risk, so if you’d like to find out more, please feel free to get in touch for a chat.