A few years ago i went out boating on Sydney’s Middle Harbour with a work mate. On the way down to the boat ramp we pulled up at an ATM to grab some cash to cover the weekends spending. I slipped my card into the ATM, punched in my PIN, and withdrew $200. At that moment, my buddy looks up at the ATM screen and sees my bank balance… then turns to look at me. It’s as if he has seen the most unbelievable thing he has even seen in his life – his jaw hit the floor. He was absolutely flabbergasted. The type of flabbergasted you get when facts are so far out of whack with your expectation that you just stand there saying ‘no way’, ‘surely not’ , and ‘it cant be’ over and over again. The type of flabbergasted you’d be if you glanced up saw your mates bank balance showing a lazy few million $….. except this was the exact opposite. Yep, my $3.15 bank balance absolutely knocked him for 6.

‘Dude, are you ok?’ he says.

‘Yeah, why?’ i replied.

‘You’ve got $3.15 in your bank account’.

‘Yeah, yeah, its all good’.

‘But seriously, you’ve got $3.15 left’

‘i’ll be fine, i’ve got a couple of bucks in another account’ i replied.

It was really quite an interesting experience. He simply couldn’t reconcile what he knew of me with a bank balance that couldn’t even cover rent or put food on the table. I was his manager at the time – he knew i was no fool, and that i was good with maths & business financials so he simply couldn’t get that i could be so bad with money and managing my personal finances.

I never did bother to elaborate much at the time, but perhaps i’ll send him a copy of this article.

You see, a ‘savings’ or cheque account is just about the worst place you can have your money stashed (other than under your mattress), because the interest earned on the balance is pitiful. At that time there were so many better places to have my money that i only ever kept the minimum required in my transaction account, and It’s still how i live today. My wife and i have ALL of our cash stashed in places that either earn us, or save us a far greater return than they would get sitting in your run-of-the-mill Big 4 Bank transaction account. Here is where my money really was:

Extra Repayments on my Mortgage.

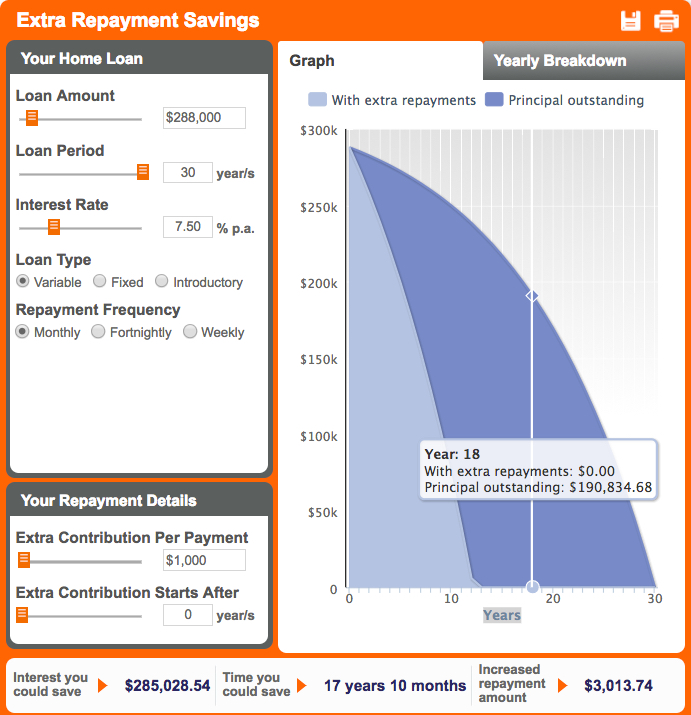

At the time i had a $288,000 mortgage for an investment property i had up the coast. The interest rate at the time was 7.5%. This meant that my Principal + Interest Repayments were $2,014 p/m, however, i was powering ahead and paying down $3014 p/m. That extra $1000 per month would save me $285,000 over the life of my loan, and pay off the house in 12 years & 2 months as opposed to 30!

*Nb: Mortgage Offset accounts in those days weren’t as common as they are today and i didn’t know then what i know now, so these i would structure things very differently.

From ING ‘extra repayments’ calculator

I wasn’t terrible with money at all, in fact, i was quite good at managing my finances, and that was before i became a financial planner. Today things are quite different, but i’m still always crying poor because my funds are being directed to the best earning (or saving) sources. In fact, i’ll go as far as saying that i hate having too much cash around. Having enough for immediate living expenses and an emergency fund is absolutely critical, but if i’ve got excess beyond that, its going to one of the following places:

- Paying down ‘Bad Debt’ (i don’t have any of this type of debt, but if you do, read ‘Good Debt vs Bad Debt’ and get rid of it!

- Our PPOR Mortgage offset account (not our investment property offset account, because that interest is tax deductible)

- Quarterly contributions to our family managed fund

- Additions to our direct share portfolios

Where my cash isn’t going:

- ‘Bad Debt’ interest repayments (car loans, personal loans, credit card debt)

- A Big 4 Bank ‘savings account’

- Paying bills (until the date they’re due) – We’d rather have the cash in our account offsetting our mortgage interest daily!

- Groceries, petrol, and living expenses – we use a credit card for that. Why? Because for 55 days, we can use OPM (other peoples money) to pay for these living expenses interest free, while our cash sits in offset and saves us interest. Always make sure to pay off your card balance in full each month so you never pay credit card interest.

So thats me, i’m often ‘crying poor’ because my (transaction account) bank balance is super low. But what i really mean when i say ‘I can’t afford it’, or ‘cash is a bit tight at the moment’ is ‘I’ve allocated cash elsewhere, and i won’t touch my investments to finance ‘lifestyle expenditure’.

So if you’ve got cash piling up in a savings or cheque account without a specific goal for it (house deposit for example), stop patting yourself on the back. It might be nice to look at that healthy bank balance, but there are so many better places your free cashflow could be going. And, when you factor in the effect of compounding, the returns / savings on offer can be absolutely astounding!

If you have excess cashflow beyond your needs (and some of your wants too – i’m not the fun police!) and you’re not sure how to put it to best use, get in touch for a chat to see if i can steer you in the right direction. When you see the savings / returns on offer, you’ll be falling all over yourself to empty your bank account and join me in the (fake) poor house.

Happy Investing.

A very simple but powerful explanation of “the fake poor house.” I love that expression. Brilliant article and thanks for sharing.