The most valuable thing you never learned in school.

I hated maths in school – not because i wasn’t any good at it, but because 99% of the time i failed to see the practical application of anything i was learning in the real word (for my personal journey anyway- i’m sure the physicists out there would disagree)

Even throughout my career in businesses operations, the most intense analysis i performed consisted of what is essentially basic arithmetic and ratio analysis. Not once have i used a quadratic equation, algebra, calculus, or geometry!

All that said, i do have one regret. Perhaps i wasn’t paying enough attention, or perhaps my teacher just didn’t engage me in the right way…

whatever the reason, i wish i could go back in time, march into my year 10 maths class, shake myself and say ‘Saul, listen up – in about 2 minutes time, Mrs Jones is going to write something on that blackboard that will change your life forever. Learn it and apply it, start now, and you will be a wealthy man’. Well, as it turns out i didn’t get a visit from my future self in year 10, and it took until my mid 20’s to truly discover the importance of this simple concept, but fortunately thats still early enough for it to change my life… I’m talking about Compound Interest.

Let me give you an example….

If i was fortunate enough as a 15 y/o in 1999 to receive a visit from my future self, and he told me to invest $400.00 in an ASX index fund, increase my yearly investment amount by $100.00 each year and just pretend like the money didn’t exist, 18 years later my wealth today would look something like this….

$52,786

Of that sum, i would have chipped in $23,600 out of my own pocket.

Seems ok right. Might buy me something cool, could be an epic 2-year holiday, or it might be a deposit for a house. Or… because at this point my investment instalments are only costing me $2200.00 per year, i might just decide to keep up the routine for another 18 years…

In 2035, as a 51 y/o my yearly investment routine has ‘cost’ me $81,400, but the good news is that now my investment looks something like this…

$380,762

Wow. Now we’re talking. That’ll pay the balance of the mortgage, cover my daughters wedding, put all 3 kids through uni, take the wife on an extended holiday, and buy a new car….. or, since my investment instalments are only costing me $4300.00 per year i could just keep up the routine till retirement at age 65.

Since i don’t miss it, i just keep contributing a small % of my wage to my (not so little anymore) nest egg until i’m 65. In 2049 i hit retirement age and my rainy day money is worth…

$1,403,241

Now to be clear, this is not my net worth at this point. This doesn’t include my superannuation which has been compounding away in a similar fashion but getting much larger yearly contributions, (circa 10% of my before tax wage) or the other assets that i have acquired, no, this is just the result of my rainy day money compounding away at the long term stock market average return of 9% p.a – and i have built this wealth by contributing only $147,900 of my ‘hard earned’ capital.

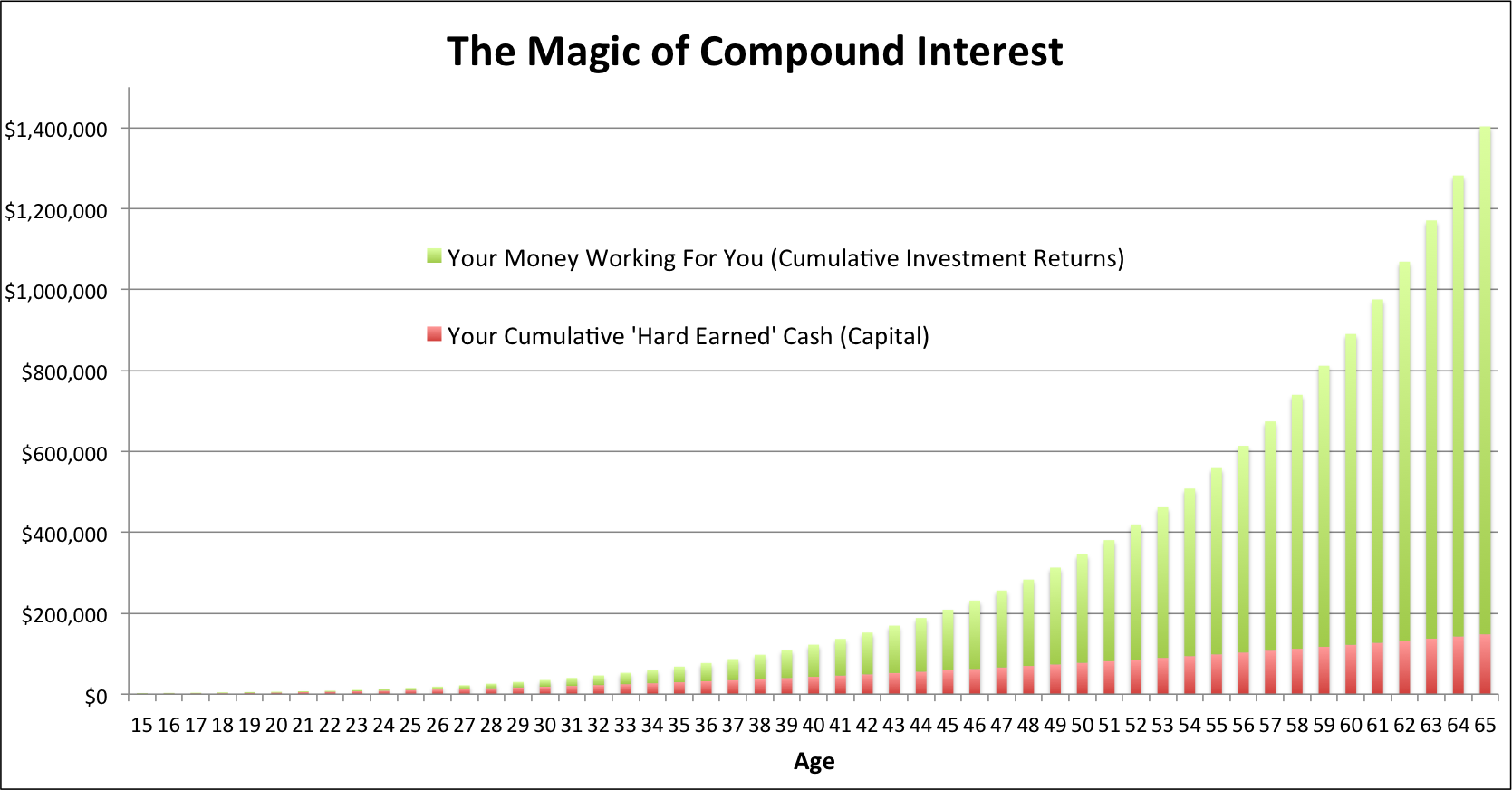

Heres is what compound interest looks like.

*Contributions made at beginning of each year. Does not consider the effect of taxation or brokerage.

Now, just to make things really interesting, lets pretend that it wasn’t my future self who bestowed upon me the wisdom of compound interest… It was my Great Aunt Ethyl, who also happened to leave me $10,000 in her will in order to kick me off on my investing journey. My total investment contribution, interest, and total investment value at the same 3 age points would look like this.

| Year | Age | Actual Capital Contribued | Investment Returns | Total Value |

| 2,017 | 33 | $34,700 | $69,503 | $104,203 |

| 2,035 | 51 | $91,400 | $531,901 | $623,301 |

| 2,049 | 65 | $157,900 | $2,055,839 | $2,213,739 |

So my $10,000 kick starter has helped boost my investment by an extra $810,498 by the time i hit retirement. Thanks Aunty Ethyl!

Compound Interest truly is just about the closest thing there is to magic, and if there is one mathematical concept i’d encourage anyone i care about to embrace, this would be it. Start early, contribute consistently, and let time do its thing.

Happy Investing.

For the full workings, please see below.

If you have a future financial goal, compounding investment returns can help you get there. Be sure to discuss the best approach for your unique personal circumstances and risk tolerance with a licensed financial planner.

| Annual Investment Returns | 9% | ||||

| Year | Age | Start Balance | Yearly Investment | Investment Return | Closing Balance |

| 1999 | 15 | $0 | $400 | $36 | $436 |

| 2000 | 16 | $436 | $500 | $84 | $1,020 |

| 2001 | 17 | $1,020 | $600 | $146 | $1,766 |

| 2002 | 18 | $1,766 | $700 | $222 | $2,688 |

| 2003 | 19 | $2,688 | $800 | $314 | $3,802 |

| 2004 | 20 | $3,802 | $900 | $423 | $5,125 |

| 2005 | 21 | $5,125 | $1,000 | $551 | $6,676 |

| 2006 | 22 | $6,676 | $1,100 | $700 | $8,476 |

| 2007 | 23 | $8,476 | $1,200 | $871 | $10,547 |

| 2008 | 24 | $10,547 | $1,300 | $1,066 | $12,913 |

| 2009 | 25 | $12,913 | $1,400 | $1,288 | $15,602 |

| 2010 | 26 | $15,602 | $1,500 | $1,539 | $18,641 |

| 2011 | 27 | $18,641 | $1,600 | $1,822 | $22,062 |

| 2012 | 28 | $22,062 | $1,700 | $2,139 | $25,901 |

| 2013 | 29 | $25,901 | $1,800 | $2,493 | $30,194 |

| 2014 | 30 | $30,194 | $1,900 | $2,888 | $34,982 |

| 2015 | 31 | $34,982 | $2,000 | $3,328 | $40,311 |

| 2016 | 32 | $40,311 | $2,100 | $3,817 | $46,228 |

| 2017 | 33 | $46,228 | $2,200 | $4,359 | $52,786 |

| 2018 | 34 | $52,786 | $2,300 | $4,958 | $60,044 |

| 2019 | 35 | $60,044 | $2,400 | $5,620 | $68,064 |

| 2020 | 36 | $68,064 | $2,500 | $6,351 | $76,915 |

| 2021 | 37 | $76,915 | $2,600 | $7,156 | $86,671 |

| 2022 | 38 | $86,671 | $2,700 | $8,043 | $97,415 |

| 2023 | 39 | $97,415 | $2,800 | $9,019 | $109,234 |

| 2024 | 40 | $109,234 | $2,900 | $10,092 | $122,226 |

| 2025 | 41 | $122,226 | $3,000 | $11,270 | $136,496 |

| 2026 | 42 | $136,496 | $3,100 | $12,564 | $152,160 |

| 2027 | 43 | $152,160 | $3,200 | $13,982 | $169,343 |

| 2028 | 44 | $169,343 | $3,300 | $15,538 | $188,180 |

| 2029 | 45 | $188,180 | $3,400 | $17,242 | $208,823 |

| 2030 | 46 | $208,823 | $3,500 | $19,109 | $231,432 |

| 2031 | 47 | $231,432 | $3,600 | $21,153 | $256,184 |

| 2032 | 48 | $256,184 | $3,700 | $23,390 | $283,274 |

| 2033 | 49 | $283,274 | $3,800 | $25,837 | $312,911 |

| 2034 | 50 | $312,911 | $3,900 | $28,513 | $345,324 |

| 2035 | 51 | $345,324 | $4,000 | $31,439 | $380,763 |

| 2036 | 52 | $380,763 | $4,100 | $34,638 | $419,500 |

| 2037 | 53 | $419,500 | $4,200 | $38,133 | $461,833 |

| 2038 | 54 | $461,833 | $4,300 | $41,952 | $508,085 |

| 2039 | 55 | $508,085 | $4,400 | $46,124 | $558,609 |

| 2040 | 56 | $558,609 | $4,500 | $50,680 | $613,789 |

| 2041 | 57 | $613,789 | $4,600 | $55,655 | $674,044 |

| 2042 | 58 | $674,044 | $4,700 | $61,087 | $739,831 |

| 2043 | 59 | $739,831 | $4,800 | $67,017 | $811,648 |

| 2044 | 60 | $811,648 | $4,900 | $73,489 | $890,037 |

| 2045 | 61 | $890,037 | $5,000 | $80,553 | $975,590 |

| 2046 | 62 | $975,590 | $5,100 | $88,262 | $1,068,953 |

| 2047 | 63 | $1,068,953 | $5,200 | $96,674 | $1,170,826 |

| 2048 | 64 | $1,170,826 | $5,300 | $105,851 | $1,281,978 |

| 2049 | 65 | $1,281,978 | $5,400 | $115,864 | $1,403,242 |

Awesome work Saul! Compound interest really is the 8th wonder of the world. Thank you for sharing.