Over the Xmas / New Year break I spent some time pursuing one of my great passions (Freediving), and it got me thinking…does Freediving make you a better investor?

In the sport of Free Diving, participants train their minds and bodies so that they are able to hold their breath for inordinate amounts of time, and travel to great depths (or lengths) underwater on a single breath. (To check out some of the insane records, check out the AIDA Website). Now I have to tell you, that achieving ‘success’ in Freediving by holding your breath as long as possible is not the most comfortable feeling in the world. If you’ve ever tried, you will know the familiar feeling of your body screaming at you to breathe after about 60 – 90 seconds. After a while, It becomes so unbearable that eventually you capitulate, empty your lungs in a panic and suck in a massive breath of sweet sweet oxygen.

A freediver, however, learns to control this urge to breathe, to remain calm when the body’s natural instinct is to panic, and to overcome all of the psychological mind games preventing them from success. In essence, being a successful Freediver means becoming comfortable with being uncomfortable… a beautiful state of mind shared by the world’s most successful investors.

Freediving – an Overview

For those of you who have never engaged in freediving, let me set the scene and share with you a recent experience from my AIDA 2 certification course….

I’m bobbing up and down about 1.5km offshore from Broadbeach on the Gold Coast, along with 4 other students, and our two instructors Clinton & Cristy from Freediving Gold Coast. The water depth is around 35m, and we’ve been exceptionally lucky with the conditions – visibility to around 22m! Still, there is no bottom in sight…. you’re just bobbing around in the big blue.

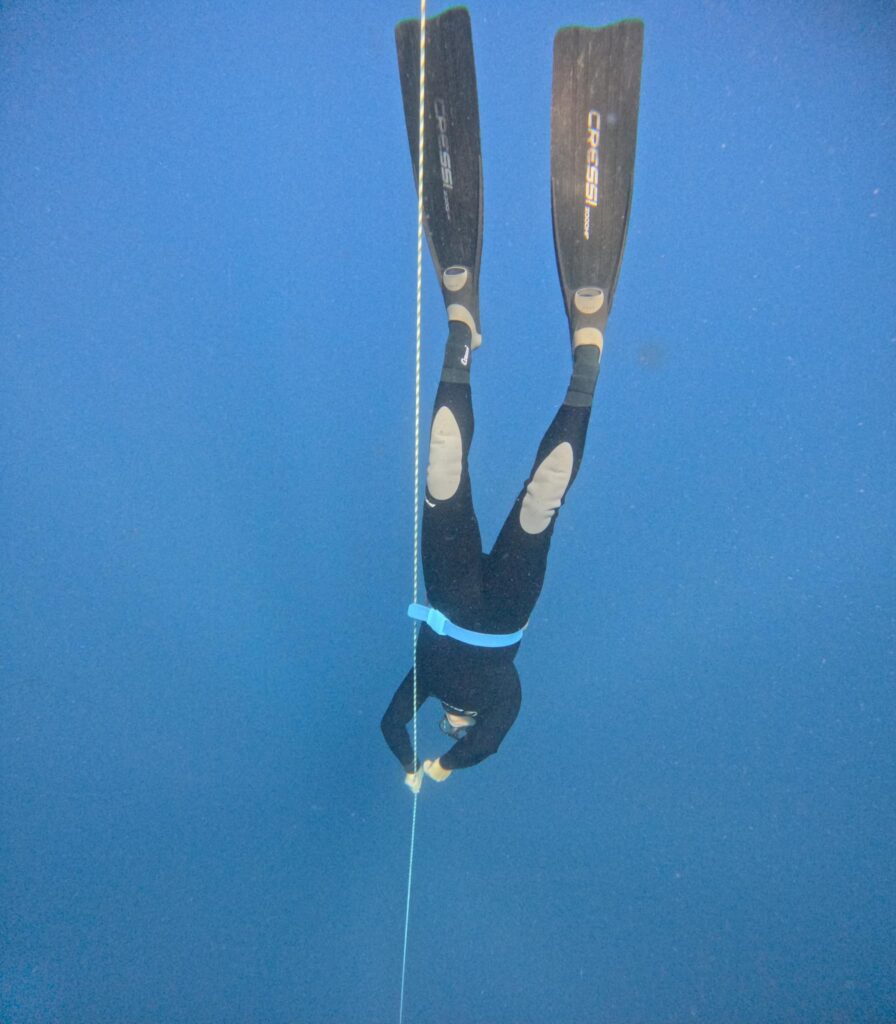

An incredible day off the Gold Coast with amazing 22m visibility and 26 degree water temps!

There is a buoy at the surface and a line with a weight on the end of it descending into the deep. In competition freediving, the goal is to descend to a nominated depth, retrieve a flag placed at the bottom of the dive line, and return it to the surface. (The AIDA 2 course however was focused on safety, and not trying to reach a personal best).

After a number of warm-up dives, and completing the safety training and rescue dives, it was time to start going deeper…

After sufficient preparation time, I duck dive and start heading down the line into the deep. The first 5 – 10m is physically harder work due to being positively buoyant – I need to exert enough effort to get past 10m depth when my buoyancy will become neutral, and then progressively more negative (I start to sink)…. this is where the mind games and the self-talk starts.

“Oh my god I’m sinking…. what if something happens and my buddy can’t reach me?…. what is this pressure I’m feeling?….My mask is being pressed against my face, and I need to keep equalising my ears way more frequently….What if I go too far and I can’t make it back to the surface?…. “wow, I’m sinking really fast now and I’m not even kicking anymore….I should turn around and head back up….OK, now I really want to breathe….It’s starting to get dark down here, I must be getting deep….Geez, it’s freezing down here….great, now my contractions have started, this feels really uncomfortable, and I’ve still got to get to the top (contractions are an involuntary spasm of your diaphragm – essentially your body is telling you it wants to breathe)… I can’t see my buddy yet, are they going to rendezvous at the nominated depth?…. and on it goes until little by little each of the feelings reverses on the return trip – the water gets warmer again, the darkness becomes lighter, you spot your buddy and you know they have your back, the swim becomes easier as you become more positively buoyant, and eventually you reach the surface and suck in your first breath in what seemed like an eternity.

I can hear you thinking… “Why would anyone in their right mind subject themselves to this torture!”.

Well, for me it’s an absolutely beautiful way to get connected with mind & body, to enjoy the wonder of the ocean (my second home), and to remind myself that we are capable of so much more than we think we are. Negative emotions (fear, anxiety, stress, panic et all) hold us back from reaching our true potential, but with training, education, support, and practice, we can learn to overcome these fears and go on to reach our true potential.

In Free Diving, you learn very quickly that we are capable of so much more physiologically than we are psychologically – and once that clicks, you start to appreciate that most of the work you need to do is in your mind.

Freediving is a great paradox in that in order to go further, longer, and deeper you don’t need to swim faster and push harder (that is incredibly counterproductive). To achieve higher levels of success you need to work smarter, not harder, you need to be calmer, more relaxed, clear your mind, let go of your fears, trust yourself (and your instructors), and be at peace with the inevitable discomfort you will experience through part of the journey.

Being a successful Freediver means becoming comfortable with being uncomfortable… a beautiful state of mind shared by the worlds most successful investors.

On my way down to 26m for my biggest dive of the day.

When the negative thoughts and emotions start creeping in it’s easy to let them spiral, but that is our irrational mind taking over. When this happens, it’s important to have science, data, and positive counter-arguments ready to draw on… these keep us rational, and on track for success.

Science / Data:

- Our urge to breathe is not regulated by a lack of Oxygen (O2), it’s regulated by the presence of Carbon dioxide (CO2). When we feel the urge to breathe, we don’t really need to – we’ve got way more left in the tank before we’re in danger of passing out.

- The “mammalian dive reflex” is an evolutionary adaptation that helps mammals conserve oxygen when their face is submerged in water – our body is programmed to help us survive.

- When diaphragm contractions commence (the uncomfortable urge to breathe), it’s actually a good thing, this kicks the body into O2 conservation mode.

- You’re more likely to get hit by lightning twice than get eaten by a shark, so just stop thinking about it.

Positive Counter-Arguments / Rational thought:

- I embrace a bit of discomfort – learning to deal with it will help me deal with whatever life throws at me!

- This isn’t my first rodeo – I’ve been here before and I was fine.

- My instructors are trained professionals with years of experience – they are not going to let me get into trouble.

- I’m diving within my limits, and I’m not pushing myself.

- I know I can hold my breath for a few minutes, it’s only been 45 seconds… I’m fine.

- My buddy and my instructors are right here – we’ve practiced rescue dives. I’m safe and in good hands.

- I know the feelings to expect at each depth milestone – they are uncomfortable but normal. It’s OK. Relax.

- The more I focus on the negative the more difficult it feels. Relax, be calm, and be free of negative thoughts.

When Investing gets Uncomfortable:

If you’re an investor in just about any asset class you’ve just been through the worst calendar year since the GFC, and in some asset classes (US Shares as measured by the S&P500 index for example), one of the worst years on record. In fact, 2022 is only one of only 4 years since records began that have recorded both a negative return for US shares, and for US government bonds.

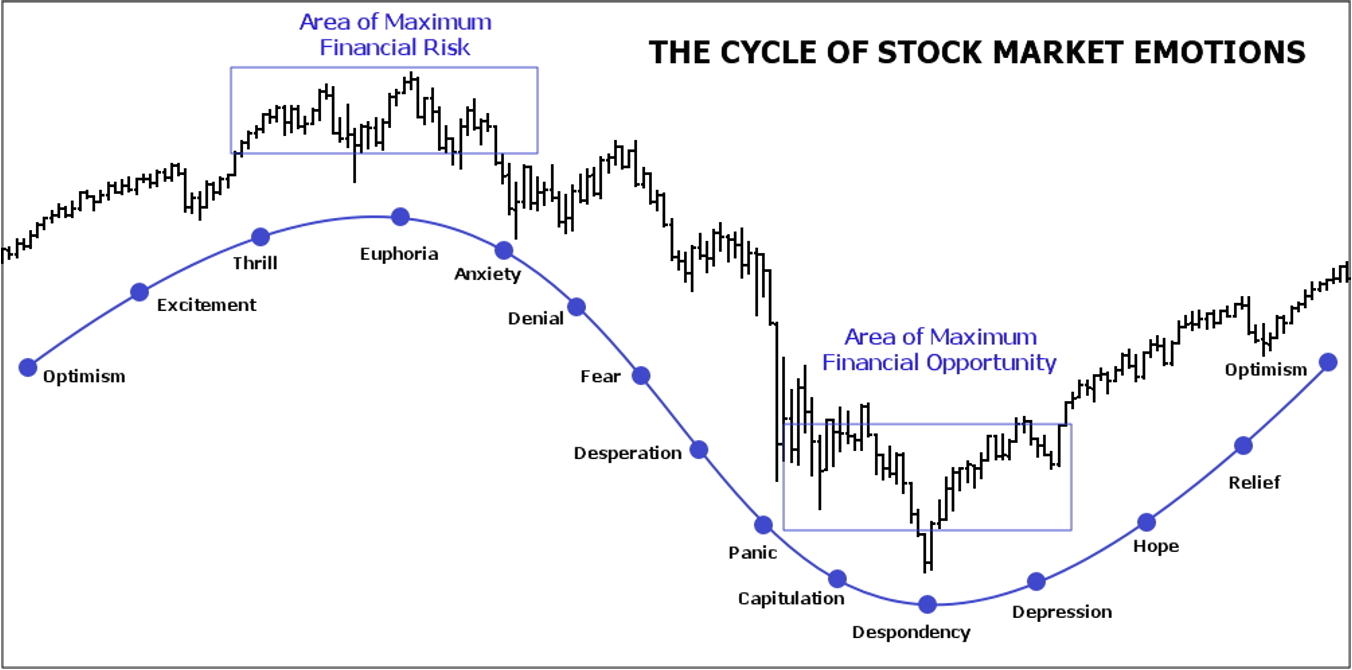

For many of you, it may well have felt like freediving into the abyss. However, it is in these moments, when pervasive negative thoughts start to creep in that investors are at the highest risk of making rash, emotional decisions – decisions that will ultimately impact their long-term success.

To help navigate negative years and stay cool under pressure it’s important to be armed with data, and some positive counter-arguments / rational thought.

Data:

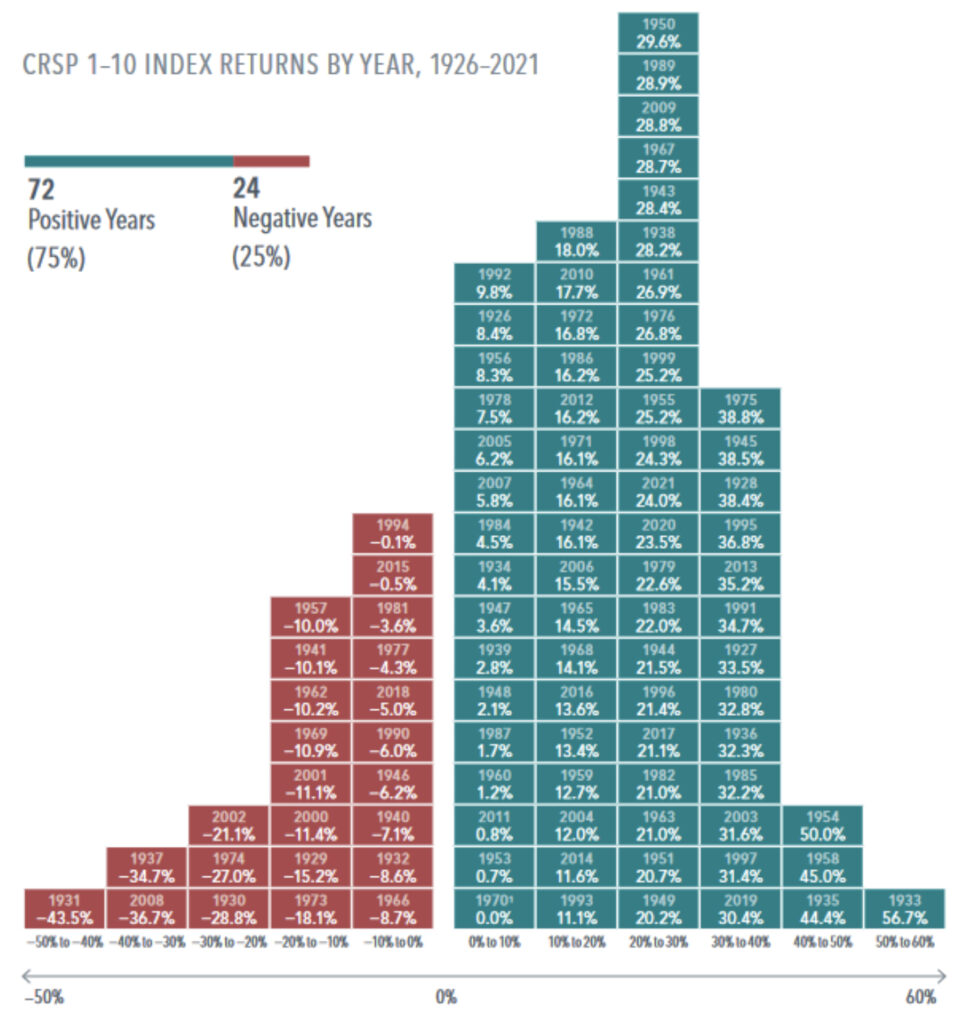

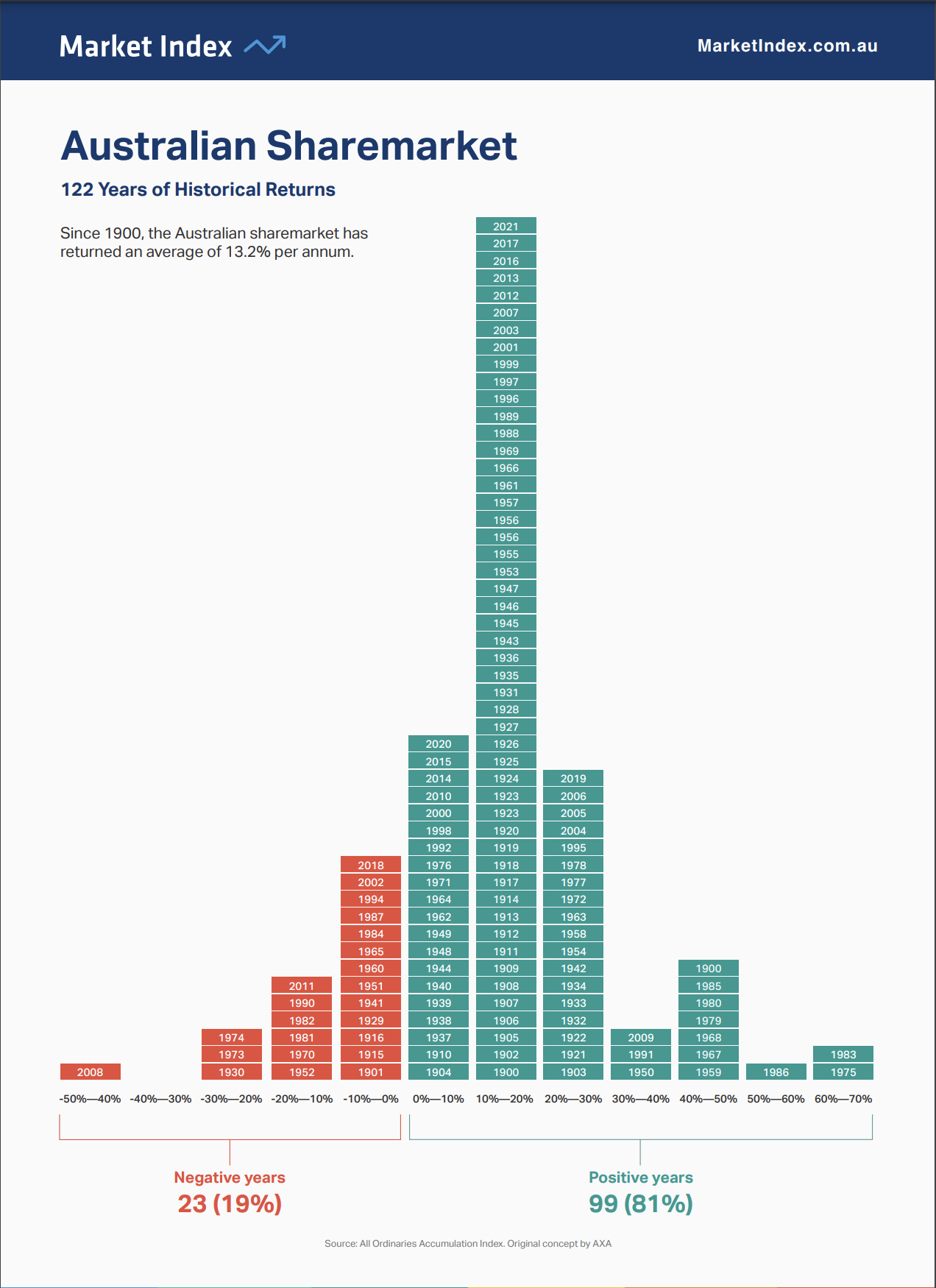

- Negative years are a normal part of investing – stock markets will experience a negative return 1 in every 4 – 5 years.

- The recent returns are not “normal” – Shares have returned 9 – 10% p.a over the last 30 years.

- Share markets have positive returns 75 – 80% of the time – the odds favour long-term investors.

- Large negative years are usually followed by a large rebound.

- The ASX200 is currently below its long-term average valuation.

- US Small companies are currently trading at valuations equivalent to the GFC lows.

- Timing the market doesn’t work – time in the market does. Stay the course.

Positive Counter-Arguments / Rational thought:

- My adviser is a trained and experienced professional, they are going to guide me through this.

- I have a long-term holistic financial plan that factors in this rough patch as a normal and expected (albeit unpleasant) part of the plan – I’m not at risk of financial ruin.

- Saul said this was going to happen at some stage – hopefully with 2022 out of the way that means onward and upward from here!

- My cash flow is still fine, I can service my mortgage, and fund my lifestyle – my investments will recover. I don’t need to sell!

- I embrace a bit of discomfort – learning to deal with it will help me deal with whatever life throws at me! (and help me put money to work when everyone else is freaking out).

- This isn’t my first rodeo – I’ve been here before and I got through it fine.

- I have the free cash flow to invest – I’m buying good assets cheaper than I was 6 months ago!

- When everyone feels the worst, it’s usually the best time to invest!

- The day is always darkest before the dawn – things will feel better soon.

- The more I focus on the negative the more difficult it feels. Relax, be calm, and be free of negative thoughts. Stop looking at my portfolio.

It may not be for everyone, but for me, Freediving is an incredible way to connect mind and body, to be more mindful, and to help remain calm under stress, duress, and pressure. And, I have to say, has almost certainly made me a better investor.

If you’d like to explore the wonderful world of Freediving get in touch with Cristy at Freediving Gold Coast.

If you feel like you don’t have the education, support, or plan in place to deal with inevitable market volatility, it may be time you sought the help of a qualified financial adviser. Book in for a 15 minute chat with myself, or my business partner Lisa Kirk at CHG Integrated Wealth to see if we can help you navigate the ups and downs of the investment world, and ultimately help you live your best life.