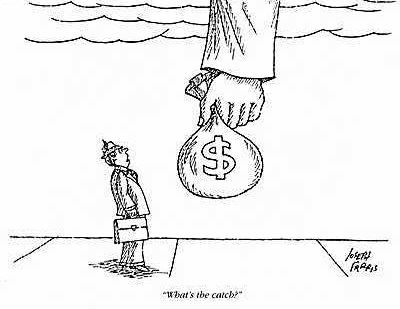

Everyone loves that time of year sometime between July and October, when roughly 14 days after the submission of their tax return a glorious lump of cash just magically appears in their bank account – as if gifted by some benevolent finance God lavishing rewards upon diligent taxpayers….

Funny not many people seem to picture a conniving old man reluctantly handing back what isn’t rightfully his….

…and ever fewer people do anything about it.

‘What are you talking about’? i hear you say. ‘Everyone has to pay taxes, there is no avoiding it’.

Well that is absolutely true, there is no avoiding your obligation to the tax man…. but nobody ever said you had to overpay him all year, and then take back the overpayments at the end.

Did you know that certain tax payers can receive their tax return in equal instalments over 52 weeks of the year rather than having to wait for a lump sum?

That’s right, certain taxpayers who have large deductible expenses can request that their employer varies the amount of tax withheld from their regular paycheque so that they are not overpaying the tax man – it’s called a PAYG Withholding Variation.

What is a withholding variation?

“Under tax law, the Commissioner of Taxation may vary the amount a payer is required to withhold from a withholding payment, to meet the special circumstances of a particular case or class of cases.

The main purpose of varying your rate or amount of withholding is to ensure that the amounts withheld during the income year best meet your end-of-year tax liability. An example is where the normal rate or amount of withholding would lead to a large credit at the end of the income year because your tax-deductible expenses are higher than normal” (ATO, 2018)

To find out more, visit the ATO website.

Lets say you own a negatively geared investment property and due to the large amount of interest payable on your mortgage, you will claim a tax-deductible interest expense of $30,000 on your tax return at the end of the year, lowering your taxable income and resulting in lower tax payable. If that tax-deductible expense lowered your taxable income down into the 32.5% bracket (from the 37% MTR bracket), it would create a tax saving of $11,385.

Now, unless you do something about it, that is an $11,385 interest free loan that you’ll be giving to the tax man. ‘Excellent’ he says…

Instead, you could enhance you cashflow by around $219.00 a week, and do something far more useful with your newly improved weekly paycheque.

- Pay off high interest personal debt (credit cards, personal loans, etc etc)

- Make extra repayments into your mortgage and start expiring debt

- Leave the cash in the mortgage offset account and save interest (roughly 2.55% p.a on the $11,385 if you add $219.00 per week for 52 weeks)

- Use the free cashflow to diversify your investments (regular contributions to a managed fund for example)

- Salary sacrifice into superanuation

- Use the funds for property improvements (which enhance its value and allow for extra tax deductions)

- Do something romantic for your wife or husband (lets face it, you would have spent the lump sum tax return on something for yourself anyway!)

- Pay for a a visit to a financial advisor so you can find out more amazing ways to make and save money and achieve your financial goals

- Increase your financial education (can be tax deductible depending on what it is)

- Make a donation (tax deductible)

Some people view their tax return as “forced saving” (i even know people who intentionally don’t tell their employer that their HECS debt has ceased in order to increase their tax withheld and artificially inflate their tax return).

I completely understand this way of thinking – particularly if you have a tendency to spend it if you’ve got it. But if you can master your temptation to spend and embrace your inner investor (or even inner saver), there are far too many wonderful benefits you could be enjoying by enhancing your cashflow.

I’ll leave you with a few words from Kerry Packer in his infamous 1991 Print Media Inquiry… and i’ll slip in a short addendum.

“I am not evading tax in any way, shape or form. Now of course I am minimizing my tax and if anybody in this country doesn’t minimize their tax they want their heads read because as a government I can tell you you’re not spending it that well that we should be donating extra” – (Kerry Packer, 1991)

…. nor providing interest free loans.