Imagine you’re on a new oddball gameshow, where you are subject to a series of questions – and pitted against the studio audience. Its not like a regular gameshow where if you’re right you’re right. Your answer – right or wrong can win you the points & advance you up the leader board, or make you crash and burn depending on the audiences answer to the same question – right or wrong.

The game show host asks a question & both you and the studio audience answer. Both answers are hidden, but your score is adjusted up or down after each question is answered – a score which is visible to both you and the studio audience.

- If you’re right & the audience is right, you win a point.

- If you’re right, and >50% of the audience is wrong you lose a point

- If you’re wrong and the audience is wrong, you lose a point

- If you’re wrong and >50% of the audience is right, you win a point.

Regardless of your answers, your points tally is linked to the audiences answer, and despite your correctness (or lack thereof) you’re at the mercy of popular opinion…. at least in the short term.

Every 20 questions, the game show host presents both yours, and the audiences answers on the big screen so everyone can see how you got to your points tally. Did you get there by fluking it? By being correct? By being unlucky?.. or perhaps just plain wrong?

Depending on the results of the 1st 20 questions, all quiz participant are likely to adjust their answers for the next round depending on their actual marks. If you’re right more often than you’re wrong, you’re unlikely to sway from your conviction in yourself and your answers. If you’re wrong more often than you’re right, perhaps you’ll learn and do better on the next round? If the audience is wrong more often than they’re right, even though it has negatively impacted your score in the short term, perhaps they’ll learn from their mistakes as the rounds go on? As they begin to answer more correctly, you’ll be propelled forward, gaining points whenever your correct answer is supported by >50% of the audience. This is the only way you win. Be right, be right often, and wait for the audience to catch up – there is no other combination that can win you the game.

Sound odd???

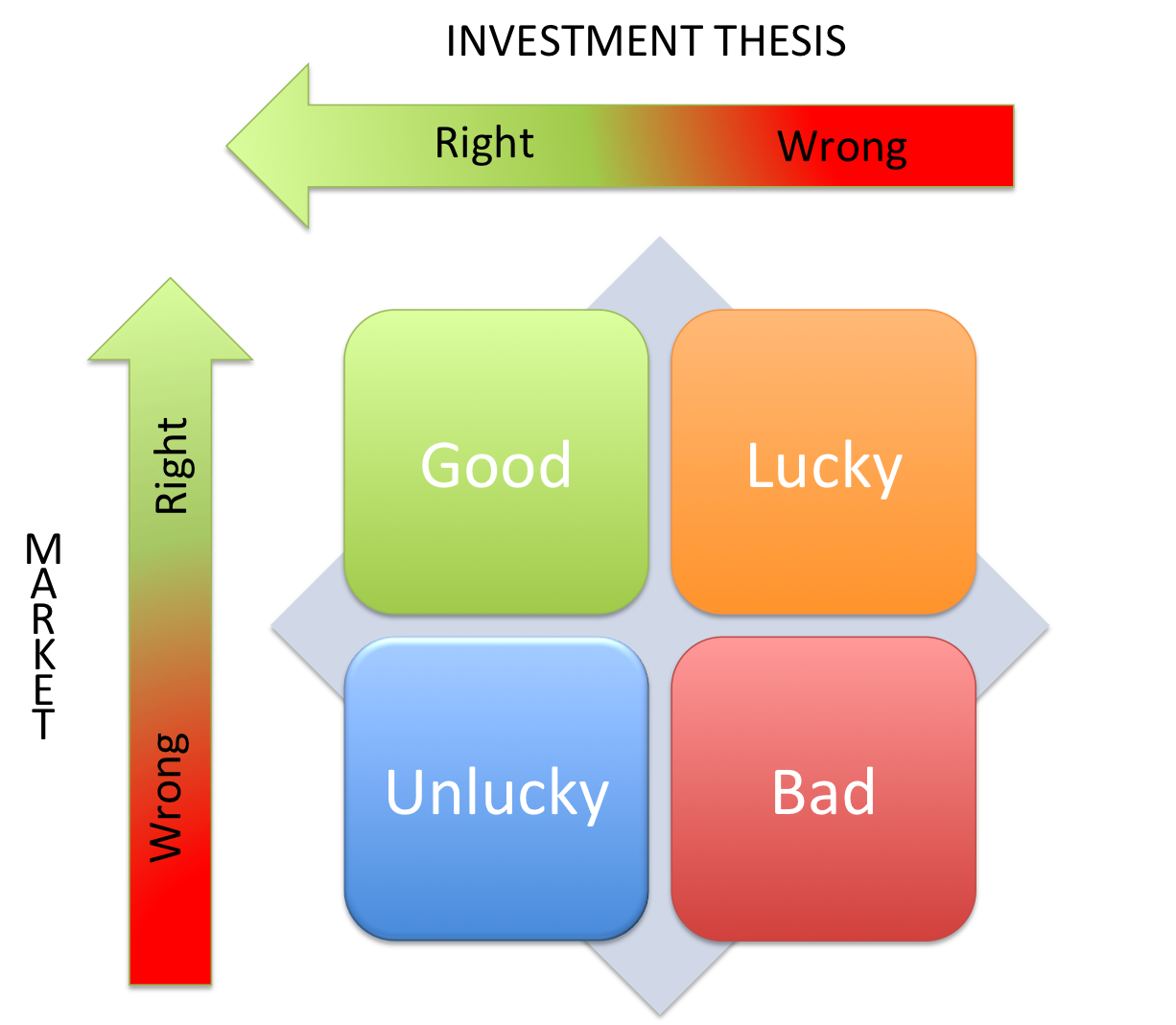

Well Welcome to the stockmarket – and the Market V’s Thesis Matrix!

You see, in the stock market the Share Price of any given company at any given time is the equivalent of your game show points balance (driven by the collective sentiment of the studio audience – or Mr Market as we refer to them in the investing game). It is actually quite disconnected from your underlying quiz results. However, if you answer correct enough, for long enough – you can never lose.

You may have stumbled across this concept before in the quotes of the investment greats “Price is what you pay, value is what you get” (Warren Buffet), “In the short term the stock market is a voting machine, in the long term it is a weighing machine” (Benjamin Graham), “The stock market is filled with individuals who know the price of everything, but the value of nothing.” (Phillip Fisher).

The key underlying concept is that if you are right enough, for long enough the market won’t be able to ignore the truth forever and will eventually vote the same way as you – If a company increases its revenue, profit & free cashflow year on year every year, eventually Mr Market will take notice and start buying the stock, pushing the share price up.

So lets explore the ways in which you can be right and wrong, and hopefully steer you toward the way with the best long-term results.

- Investment Thesis Wrong / Market Votes Thumbs Down

“Bad” Quadrant – Bottom Right

This is the worst kind of wrong. The market seems to be voting negatively toward a given stock (company), and you think the lower share price presents a compelling opportunity – after all, the share price was more the double just a short 12 months ago. It has to be good value right??!! Unfortunately many times stocks are not just cheap, they are “cheap for a reason” and i have been bitten by my fair share. The share price continues down, but anchored to your investment thesis due to confirmation bias, you continue to hold and watch your investment degrade in value convinced that the market is wrong. Only when sufficient new company announcements and reports are released that prove the companies deteriorating earnings profile & prospects do you realise your folly and sell your investment at a hideous loss. Your investment thesis was wrong, and the markets vote sent the share price down (for good reason) – Hopefully your losses have come with a valuable lesson.

If you find yourself in this quadrant more often than not, it may be time to let someone else do the stock picking for you? ETF’s, Managed Funds, or LIC’s can gain you the exposure to the stock market that you seek, with the benefit of an experienced investment professional looking after your capital. Check out Are you Beating the Market? for more info.

2. Investment Thesis Wrong / Market Votes Thumbs Up

“Lucky” Quadrant – Top Right.

This is where you thank your lucky stars that your incorrect thesis didn’t land you in the ‘Bad’ quadrant. Fortunately for you, there were enough other investors who also had the same flawed investment thesis, and the increasing interest in the stock pushed the price up and made your investment profitable. This is also the realm of “momentum traders” and crypto currency “investors” – A bet that someone out there will be willing to pay a higher price than you, and hence push up the share price despite the validity of the underlying investment thesis. (The Bigger Fool Theory). For many, profiting by being in this quadrant is just plain dumb luck, and for others it is a study of ‘technical trading’ or charting. Technical trading is the study of the share price charts of an underlying asset. It is an attempt to analyse the collective sentiment of the market, but gives no credence whatsoever to the performance or value of the underlying asset (such as the specific company & its revenue, profit & cashflow). Be warned, being in the “lucky quadrant” might provide you short term results while the truth remains hidden, but once the underlying value of the investment is revealed in financial reports, (downward) price adjustments can occur quickly and savagely.

If you find yourself in this quadrant too often, you may just be the luckiest person in the world. Luck doesn’t last for ever though, so consider taking your profits and joining your buddy from point 1. above by using a Fund Manager – at least courtesy of your windfall you’ll have a bigger starting balance than he will!

3. Investment Thesis Right / Market Votes Thumbs Down

“Unlucky” Quadrant – Bottom Left.

This is the most frustrating quadrant to be in – and the worst part is that you don’t know if you’re in the ‘unlucky’ quadrant, or just the ‘bad’ quadrant until your investment thesis is proven correct or incorrect in the fullness of time. I have been in this quadrant with certain stocks for many years as the market voted differently to me. Confident in my thesis, i held in the face of a falling share price. As new audited financial reports (the only source of truth and validation) became available, i analysed them, revisited my investment thesis and made a decision about whether or not to hold. Warning… holding in the face of popular opinion is not fun or easy. For a quick insight into how it feels its worth revisiting the reactions of the protagonists from “The Big Short”.

This is the realm of the “Value Investor” – one who’s analytical skills make them confident enough to go against the grain, and to find value where the market chooses to ignore it. Investors in this quadrant – provided that their analysis is sound, and that they have a mastery of their own cognitive biases will eventually move to the “good” quadrant – or perhaps more correctly, the market will realise that they were right all along… and jump onboard. Unluckiness can’t last forever, but incorrectness can.

If you find yourself in this quadrant (or you think you’re in this quadrant), calmness, rationality, and a mastery of your own cognitive biases will guide you in the right direction – but these things take time. Inexperienced investors will be faced with a rollercoaster of emotion & some very difficult decisions (should i sell & preserve my capital, or should i hold cause i’m right – i am right aren’t i?… i’m sure i’m right… please be right, oh god i’d better be right!!!)

Voting against popular opinion is unnatural and it’s difficult, but for the skilled & patient investor, it can also reap fantastic rewards.

4. Investment Thesis Right / Market Votes Thumbs Up

“Good” Quadrant – Top Left.

This is the perfect combination of having a correct investment thesis, and having the market agree with you. Audited financials released every 6 months support your investment thesis, and the market continues to reward the company’s underlying financial performance with high earnings multiples. (P/E Ratios). This is a most gratifying place to be, and here is what it looks like…

CSL is the amongst the highest pedigree of Australian companies, and has consistently increased it’s earnings (profit) over the last 10 years – as a result, its share price has increased almost 3 fold in the last 5 years. Investors in this quadrant will always do well, but investors shouldn’t become complacent. Revisit your investment thesis, understand the company’s fundamentals, and track its performance so you that you know that the share price is climbing for the right reasons – not just cause the company is winning a popularity contest.

So no matter what your portfolio returns look like, its worth pausing from time-to-time to consider how you got there. Was it dumb luck? Was it just plain bad luck? Was it perhaps being right all along, but just unlucky, or are you one of the few who can proudly say that your stellar portfolio returns were achieved by being the best kind of right?

Happy Investing.

Saul.

Nice one Saul. All good about CSL but maybe at PE ration of 40 it is starting to win some popularity contests after all, and not just working long hours in the lab!

I remember the Fisher quote as being from Oscar Wilde – “a cynic is someone who knows the price of everything, and the value of nothing”. Interesting.