I had a chat with a mate of mine this morning – a 30 y/o self-employed tradie. He works hard, he pays his mortgage, he has some investments, but during the call, he mentioned that he hadn’t contributed to his super for 3 years (since becoming self-employed).

Me shortly after…

After I managed to regain my composure I encouraged him to make provisions for super contributions so that he doesn’t fall behind his PAYG peers – who just magically get their super contributions quarterly. He thanked me for bringing it to his attention and that was that.

After our call I got thinking… I know why it’s important, I know that compounding returns over a long time makes an extraordinary difference, but I’d never really taken the time to quantify the impact of simply taking a year or two off. So… I got out my trusty spreadsheet and built a ‘what if’ model that assessed the impact of taking time off from super contributions, and I’ve got to tell you… even I was shocked!

BY PAUSING YOUR CONTRIBUTIONS – EVEN FOR A FEW SHORT YEARS, YOU ARE POTENTIALLY ROBBING YOUR FUTURE SELF OF HUNDREDS OF THOUSANDS OF DOLLARS

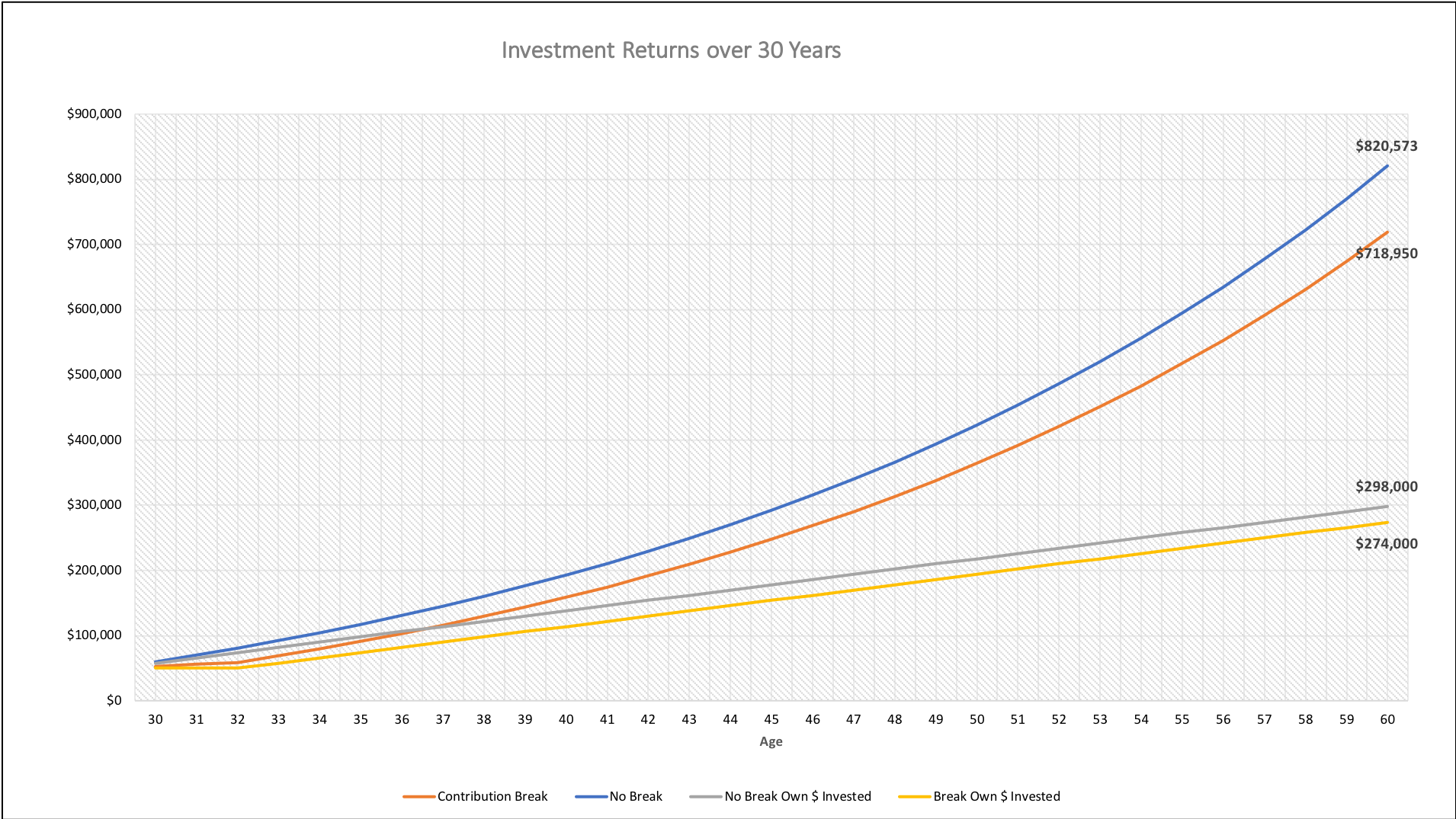

*Assumes starting balance of $50,000, gross salary of $84,211, 9.5% SG contributions, 8% net returns and inflation of 2.5%.

What you’re looking at is the super journey of a 30-year-old to age 60 (in today’s dollars).

- The Blue line represents the journey if the 30-year-old contributed 9.5% of his / her wage quarterly.

- The Grey line represents the total contributions made.

- The Orange line represents the growing balance of the same 30-year-old if they did not commence contributes till age 33.

- The Yellow line represents the total contributions made for our delayed start 30-year-old.

Allow me to sum up….

Contributing $24,000 less between the ages of 30 and 33 reduces the super balance at age 60 by > $100,000!

Note, if inflation was 2% rather than 2.5%, the difference would grow to >$117,000.

Time does incredible things to money, so the earlier you start compounding your investment returns (in super, or outside) the better off future you will be.

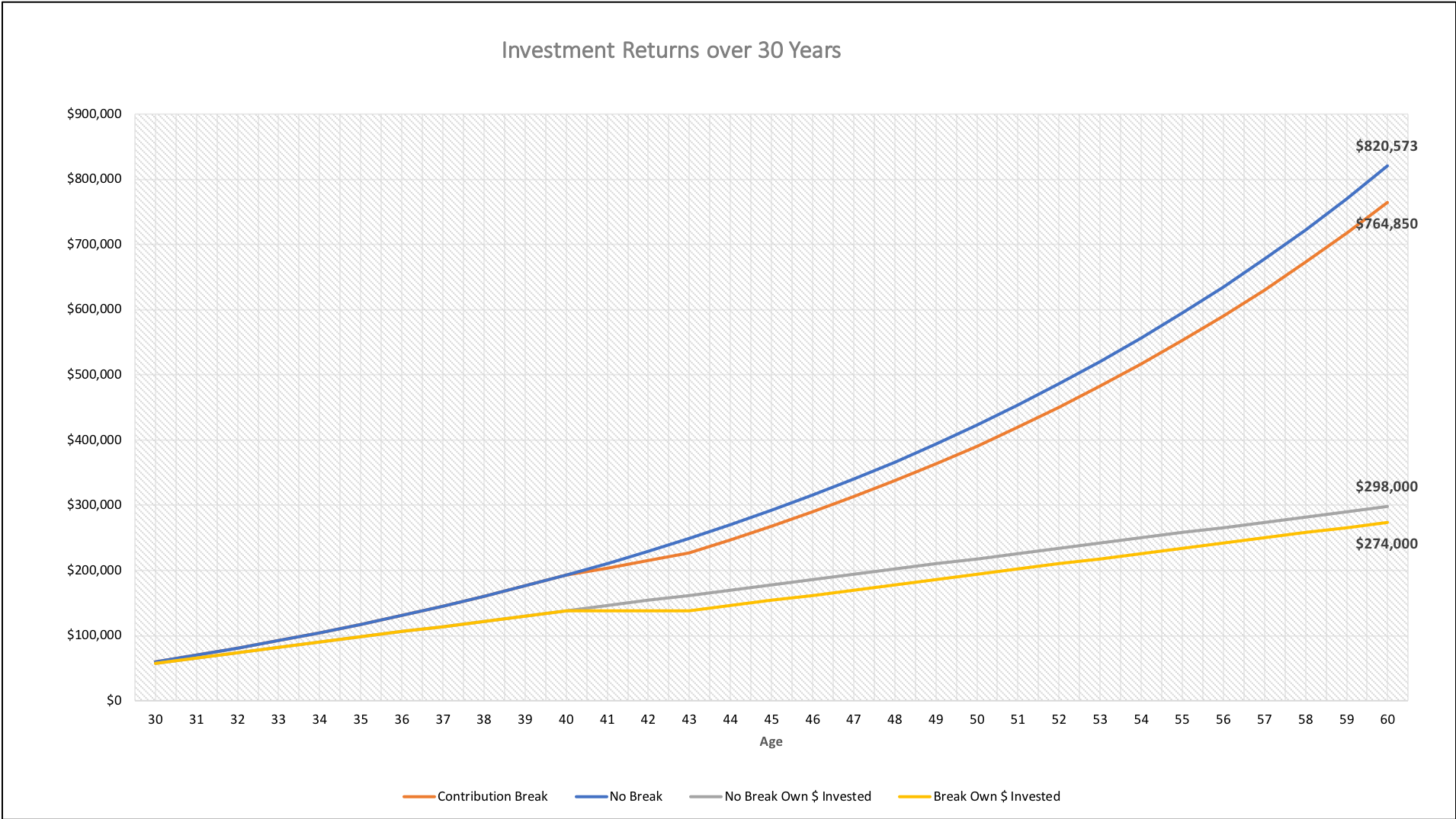

To illustrate, below is what it looks like if the same 30-year-old had the same 3 years off from contributions (to temporarily have better cashflow for example), except the 3 years were during age 41 through 43.

Because the contributions in early years have compounded for longer, this reduces the deficit at age 60 down to $55,723 (from over $100,000).

I can’t say it enough, the money decisions of present day you will impact the outcomes of future you in a profound way.

OTHER RISKS OF NOT CONTRIBUTING TO SUPER:

Did you know that if you’re in your employer’s default super fund, there is a good chance you have Life, TPD, and Income Protection Insurance within the fund?

Everyone hates insurance – until the day comes when you need to make a claim. If you have an accident, illness, or have an unfortunate run-in with a bus, having cover in place could make a world of difference to you and/or your family.

Unfortunately, if you’ve chosen to pause your contributions for a while, many super funds will switch off your insurance. This is to ensure that ongoing fees don’t eat away at your balance. Unfortunately though, your fund hasn’t made that choice for you and your unique circumstances, they’ve made it for the “average” fund member – Who’s age ranges from 16 – 65 (when most insurances automatically cease), and who’s super balances range from $500 to >$5,000,000. It might be the right decision for the average member, but completely wrong for you.

Personal insurances are important – even though paying for them sucks. If your cover ceases for some reason, you may not be able to get it back. Log into your super account and suss out what you’re paying for, what it provides you, and what it is costing you. Don’t make changes hastily though – insurance is a minefield and you should always seek advice.

GOVERNMENT CO-CONTRIBUTIONS

Did you know that if you make personal non-concessional contributions to super you may be eligible of government co-contributions of up to $500.00p/a?

That’s right. If you pass a few simple eligibility tests the good old Gov will chip in $0.50 for every $1.00 you contribute, up to $500.00 (assuming you fall below the lower earning threshold of $36,813). If you’re above the lower threshold, but under the higher threshold of $51,813, your co-contribution will reduce – but something is better than nothing! Here’s a quick ready reckoner.

Government Co-contributions

| Income | Personal super contribution: | |||

|---|---|---|---|---|

| $1,000 | $800 | $500 | $200 | |

| <$36,813 | $500 | $400 | $250 | $100 |

| $39,813 | $400 | $400 | $250 | $100 |

| $42,813 | $300 | $300 | $250 | $100 |

| $45,813 | $200 | $200 | $200 | $100 |

| $48,813 | $100 | $100 | $100 | $100 |

| >$51,813 | $0 | $0 | $0 | $0 |

So there you go – a few BIG reasons you should keep up your super contributions. If you’re a tradie, musician, artisan, or if you’re self-employed in any way, don’t forget to make provisions for “Future you” – he or she is important too!