When face masks become ‘normal’, planes fly around empty, and ordinary citizens start getting tasered for fighting over toilet paper it’s easy to let panic creep into your psyche. Investment markets begin to behave erratically, and equally convincing yet completely opposite ‘expert opinions’ start punctuating the never-ending flow of news… Twitter, Facebook, TV, the papers…

At times like this, what you do (or don’t do) with your investments can have an enormous impact on your financial outcomes. So remain calm, remember that you’ve prepared for this, and stick to your Market Crash Survival Guide.

“Periods of turbulence provide both large risks and large opportunities, so after you make sure that you and your people are safe from the risk of ruin, look for the opportunities. It is because at such times most people pay the most attention to the risks than the opportunities” – Ray Dalio, Bridgewater Associates (the worlds largest hedge fund at $160M USD)

TOP tips for surviving (and thriving) in a Market Crash.

1. KEEP CALM

Making decisions under pressure, duress, or when you’re in an emotional state is almost guaranteed to produce terrible outcomes so never make rash decisions.

2. NEVER BE A FORCED SELLER!

Never be in a position where you are forced to sell your assets at unfavorable times. Ensure you have sources of income and liquidity to get you through the inevitable bumps (and occasional crashes) along the way… they don’t last forever.

- If you’re still working your job provides for your income needs – make sure you have a budget, and a process for sticking to it. If you have free cash flow, you have incredible opportunities – be ready to take advantage of them!

- Have an emergency account or buffer – when you need to fix a problem, you need to be able to put your hands on cash… not credit or proceeds from the forced sales of assets.

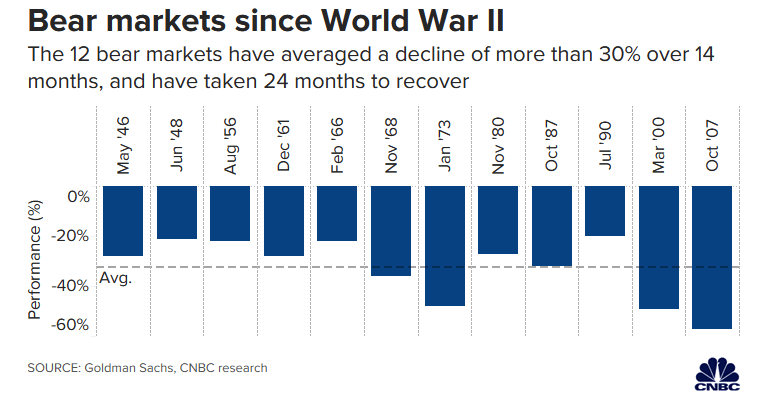

- If you’re relying on your investments for income, ensure that you have enough cash to provide your pension payments for a year or two. Bear Markets (declines of > 20% or more) don’t last forever, but they don’t recover losses overnight either.

*Data based on the S&P500 Index.

3. DON’T TRY TO TIME THE MARKET

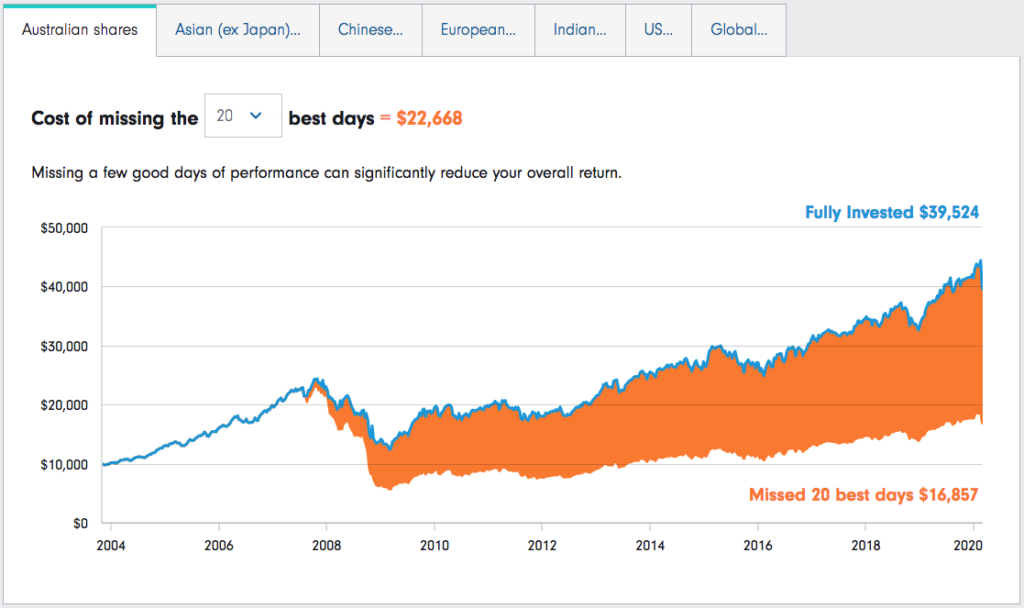

It has been proven time and time again, that one of the worst things that you can do is try to “time the market” (I should sell now to avoid loss / I should buy now, it’s an opportunity). Why?

And, missing out on a handful of the best days costs you a fortune!

4. CASHFLOW IS CRITICAL

Know what you earn, know what you spend, and do something smart with what is leftover! If you know your sources of income, you can set a budget that manages you through periods of uncertainty. It may be necessary to trim expenses, or reduce income from investments (in the case of pensions), but if you know your numbers and have a good control of your cashflow you will be in a far more solid and confident position from which to make decisions.

5. INVEST IN LINE WITH YOUR RISK PROFILE

The biggest cause of anxiety is often when investors invest outside of their tolerance for risk & volatility. If you’re on the cusp of retirement maybe tone it down on the risk factor a tad, and if you’re young & risk-averse you could be robbing ‘future you’ of hundreds of thousands of dollars by trying to steer clear of the ups & downs. Know that volatility is normal, that ‘corrections’ and ‘bear markets’ are inevitable at some stage in your investing journey, but be confident that your strategy & portfolio construction is aligned with your personal goals and objectives so you can get through the rough times without fear or panic.

6. KEEP PERSPECTIVE

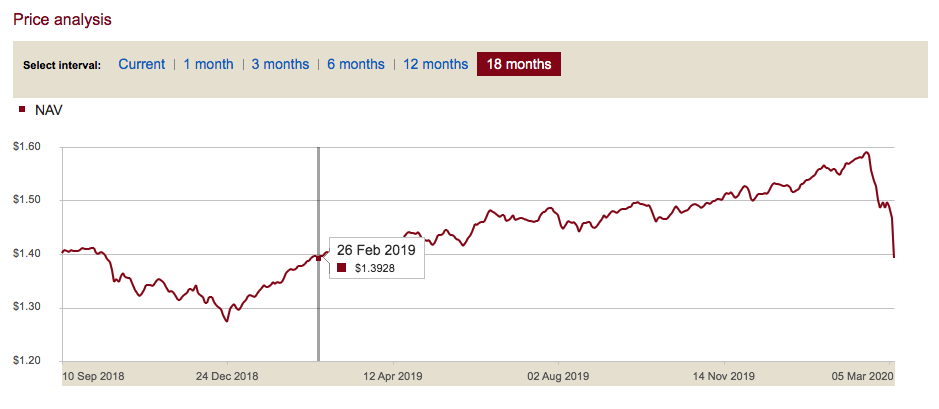

The graph below shows the unit price of a typical ‘Growth’ fund with 70% Growth Assets (Shares & Property), and 30% Defensive Assets (Cash & Fixed Interest). As of yesterday, the unit price was back to levels last seen 12 months ago – effectively no different than having your cash sitting in the bank for the last year!

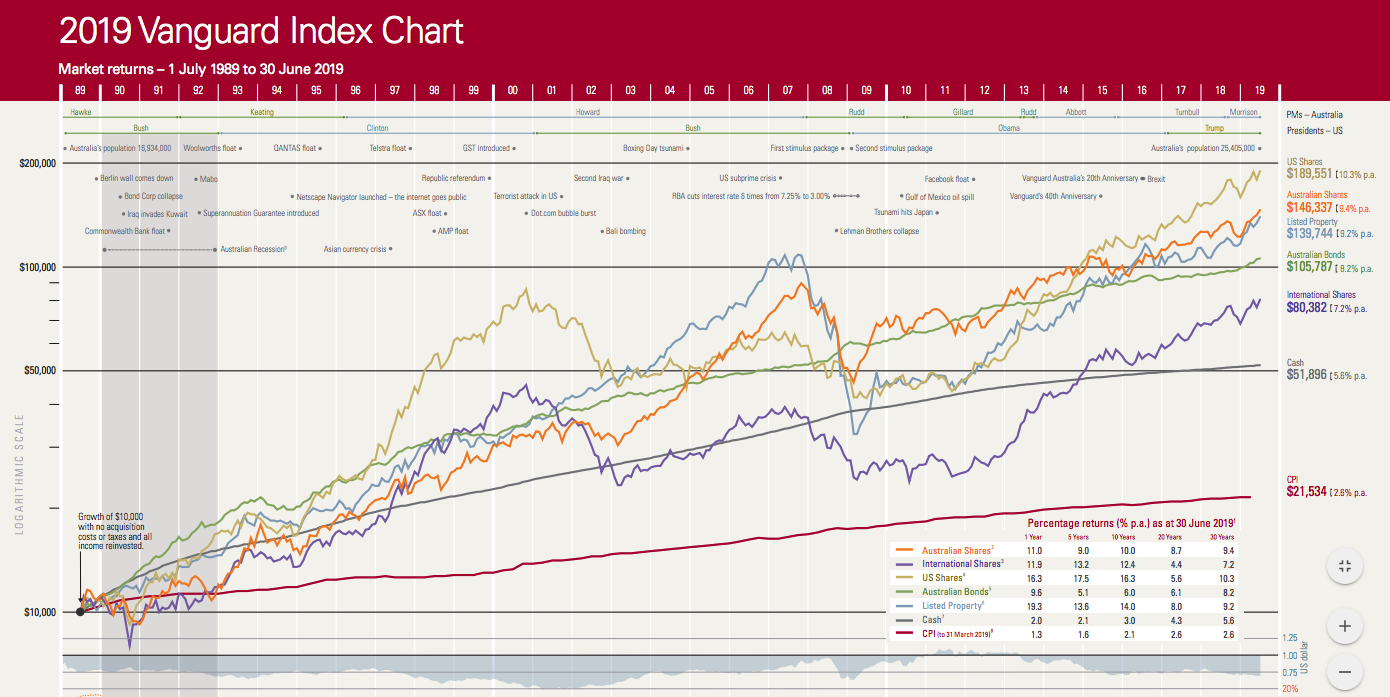

The world has seen some pretty scary & unprecedented events in the last 30 years (just check out the geopolitical events on the graph below)…. yet sharemarkets have returned 9-10% p/a over the long-term.

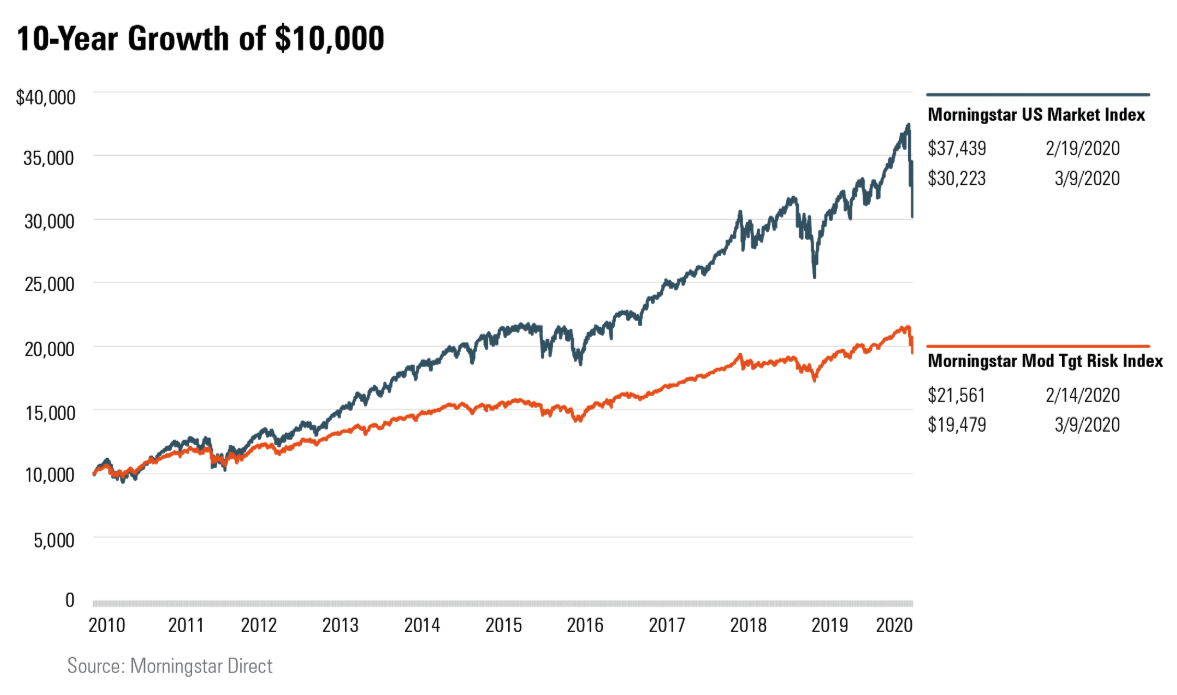

On Feb. 14, $10,000 invested in a 60/40 portfolio a decade earlier would have been worth about $21,550. After the market collapse, as of March 9, it would be worth around $19,500, roughly a 9.7% decline, but a 6.91% CAGR (Compound Annual Growth Rate) since a decade ago!

*Data based on USA 60% Stocks / 40% Bonds portfolio.

7. DON’T BE AN EMOTIONAL INVESTOR!

Whilst everything seems perfectly predictable in hindsight, at the time it is anything but. You never know exactly where you are in the ebb & flow of market valuations, so don’t try to guess.

A regular investment strategy – or “Dollar Cost Averaging” can help you avoid trying to time the market, and from going on an emotional rollercoaster.

8. MAKE SURE YOU’RE SUFFICIENTLY DIVERSIFIED

Remember, individual companies can go bankrupt… stock markets can’t!

9. MAKE SURE YOU HAVE THE RIGHT TEAM IN YOUR CORNER.

Having the right team in your corner gives you the best chance at success:

Your Adviser:

Having the right adviser means you should be confident that mountains of thought & consideration have been put into the development of your overall financial plan (not just your investment strategy), and that each of the components of your plan has been designed to meet your unique goals & objectives. When you know your overall plan is on-track, sticking with your strategy is far easier, and going through the inevitable bumps is just par for the course.

Your Investment Managers:

Once you have established a risk profile and an investment strategy, knowing that you have the right team of investment managers in your corner is an enormous advantage! I know my fund managers inside & out, and I’m extremely comfortable with the way in which they manage my capital (and that of my clients). Knowing their investment beliefs, styles, mandates, processes, underlying stocks, cash levels, historical performance in down-markets, and propensity for risk helps me remain confident that my portfolio will do what it is designed to do – and deliver the longer terms outcomes that will make my plan a success.

Once you get the right team in your corner, make sure you reach out to them when you need them! I had a great meeting this morning with one of the world’s largest fixed income managers to discuss the state of the world and the outlook for the economy (and It wasn’t nearly as gloomy as you might have thought). On Thursday I’m attending a conference from one of the largest equity fund managers in Australia and I look forward to hearing their take on the state of investment markets. Get reliable data, stick to the facts, and avoid all of the ‘noise’.

When you’re feeling uneasy, or the news headlines are getting to you, reach out to your adviser(s) and ensure that your plan is still on track to meet its longer-term objectives.

Sticking to your strategy may be tough, but more often than not it’s the best course of action. Stay focused on your longer-term goals, manage your cash & liquidity, and remember that this too will pass.